Repo: tyoungg/substack

Identifies a chart formation that often signals a bullish-to-bearish trend reversal. It is commonly used to anticipate potential breakdowns after an extended uptrend.

Patterns that form when price tests the same level twice without breaking through. These often suggest exhaustion and a potential reversal at key support or resistance.

Consolidation formations where price range contracts over time. Ascending, descending, and symmetrical triangles often precede volatility expansion.

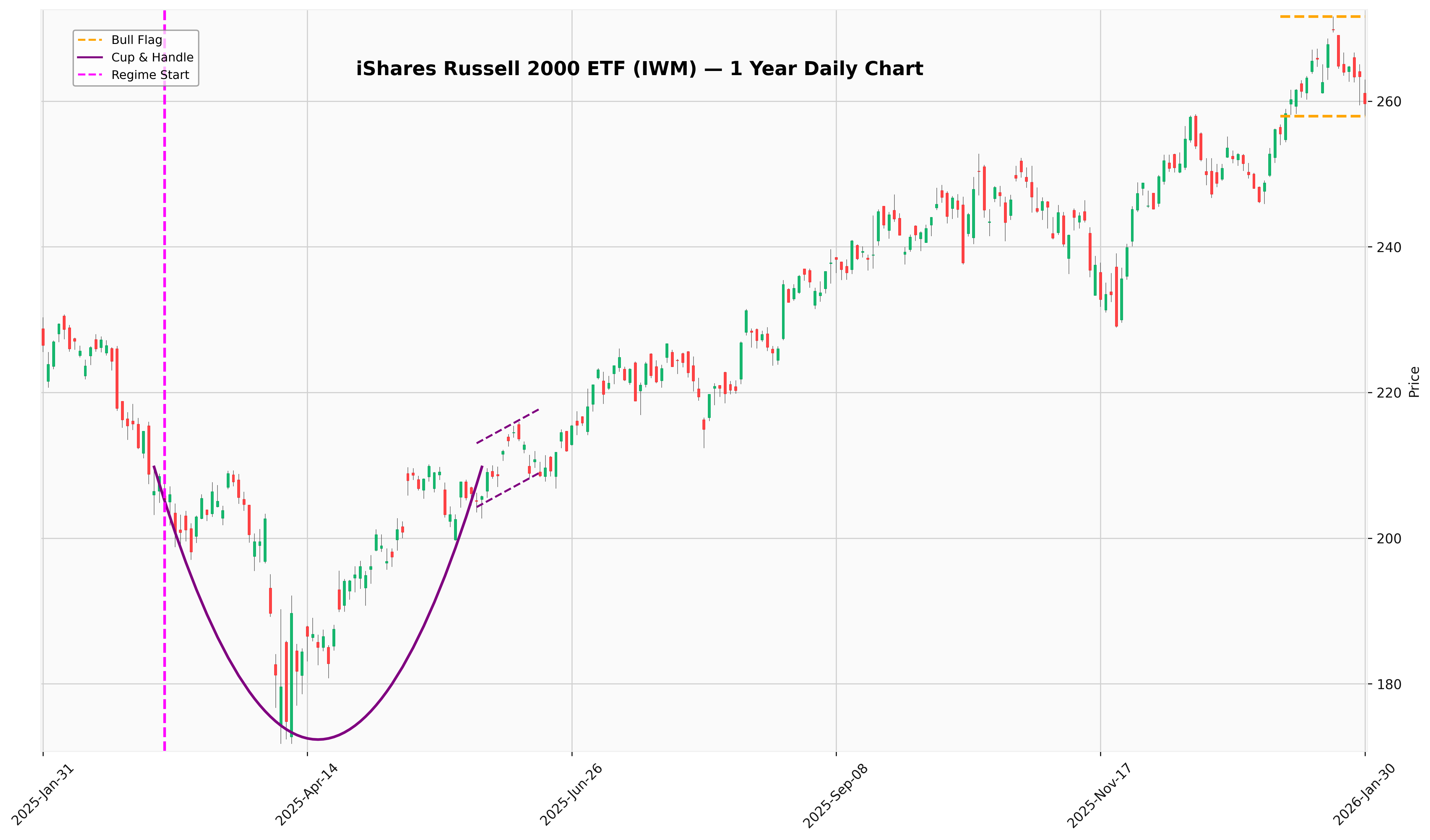

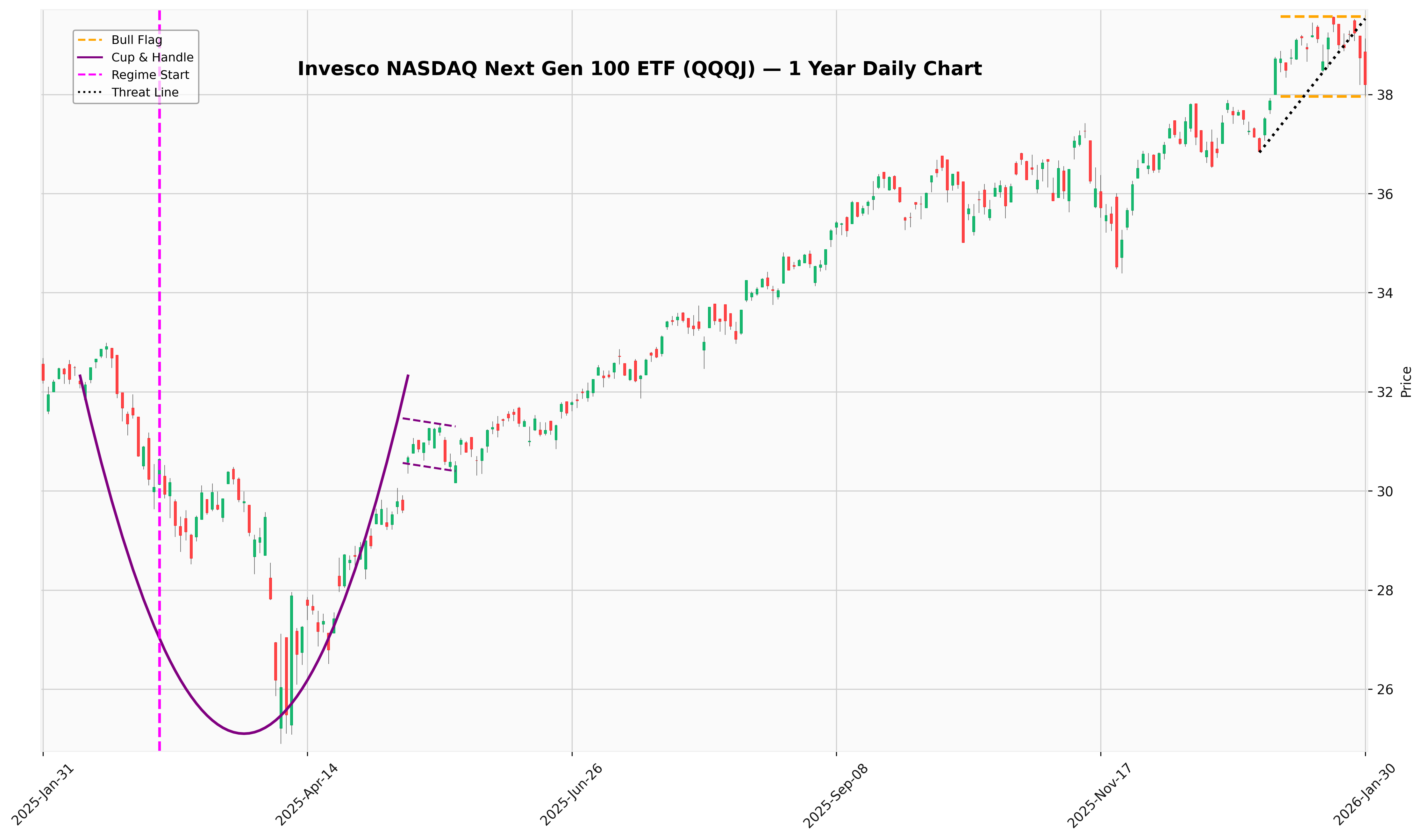

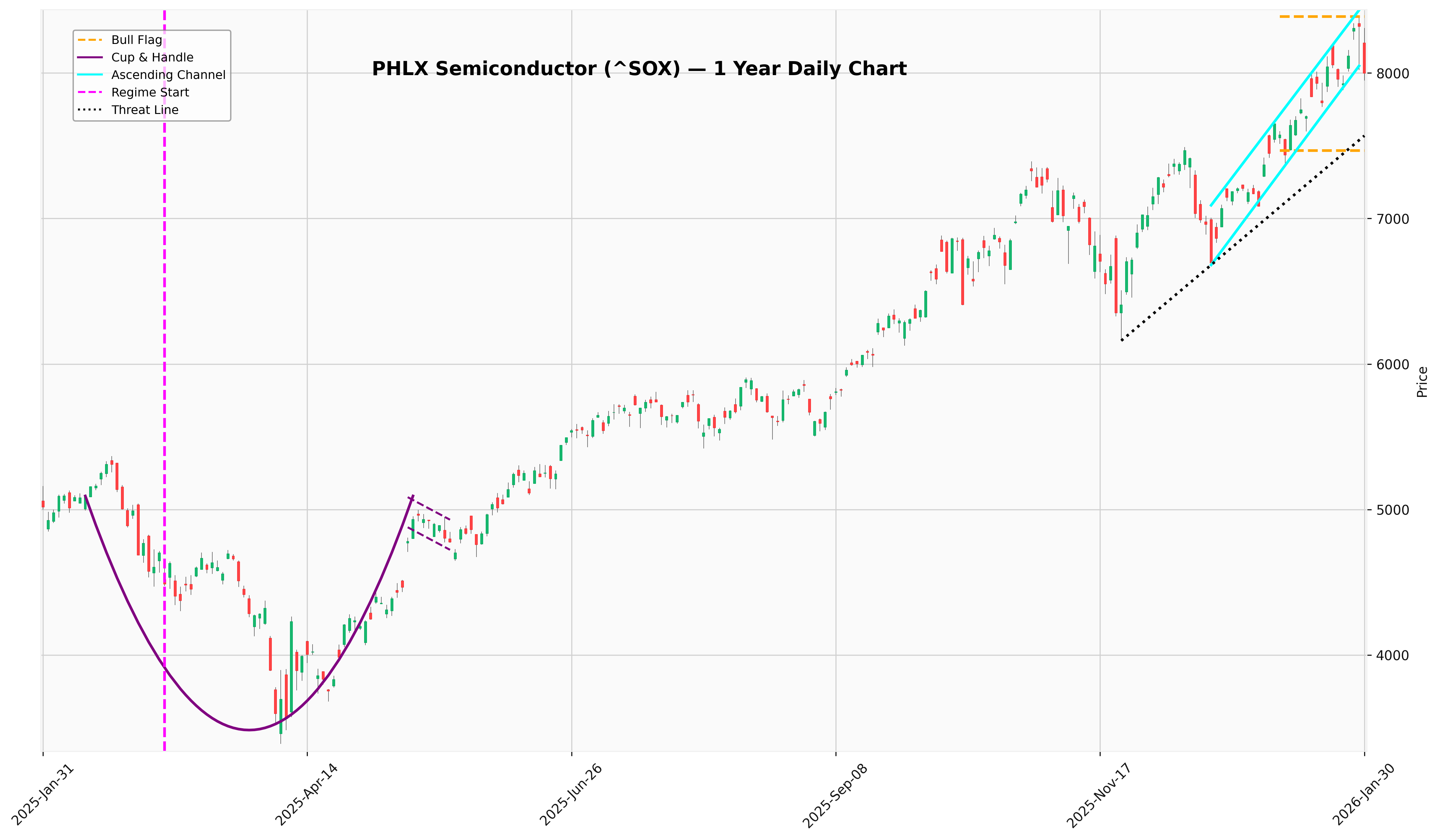

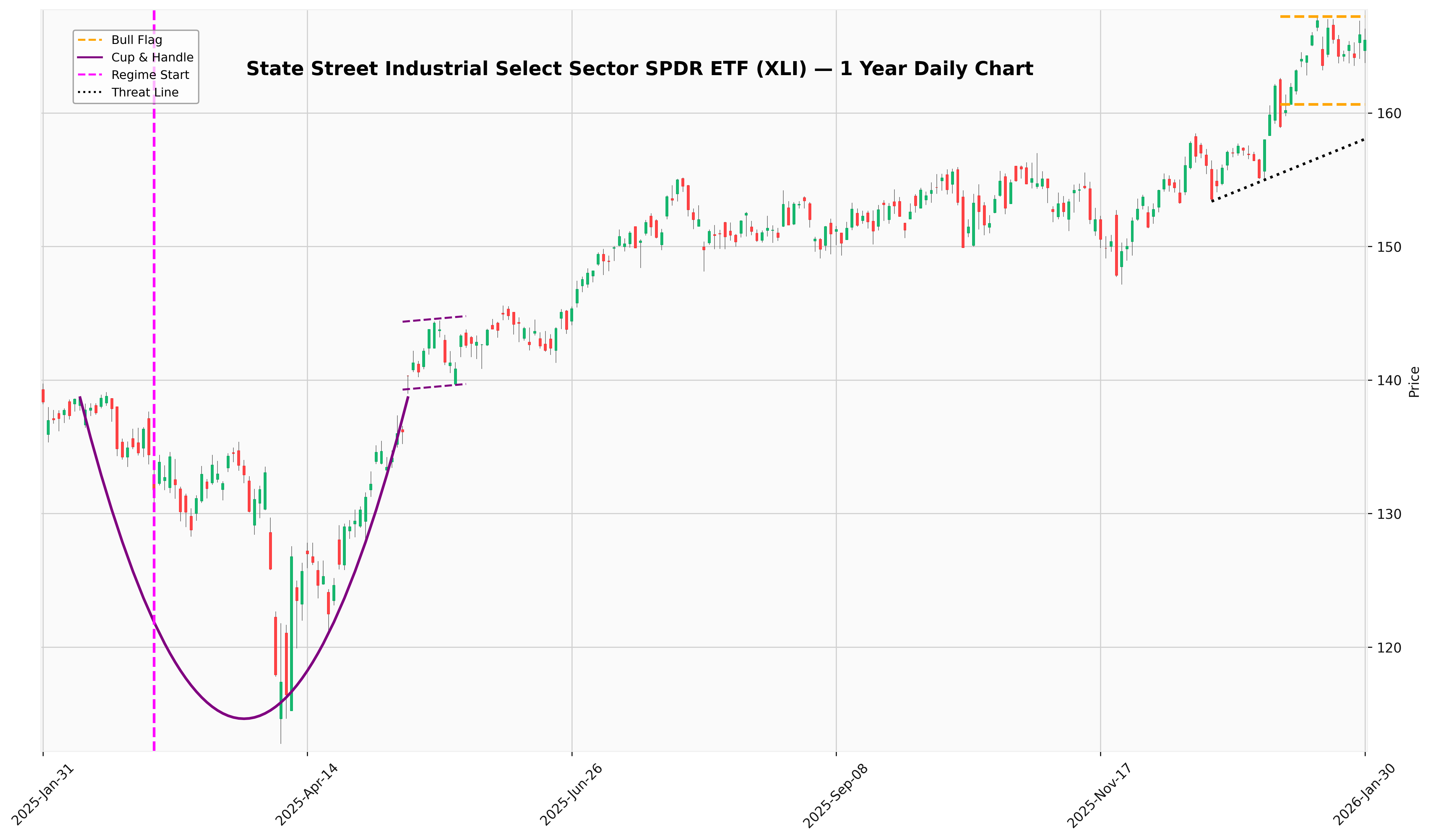

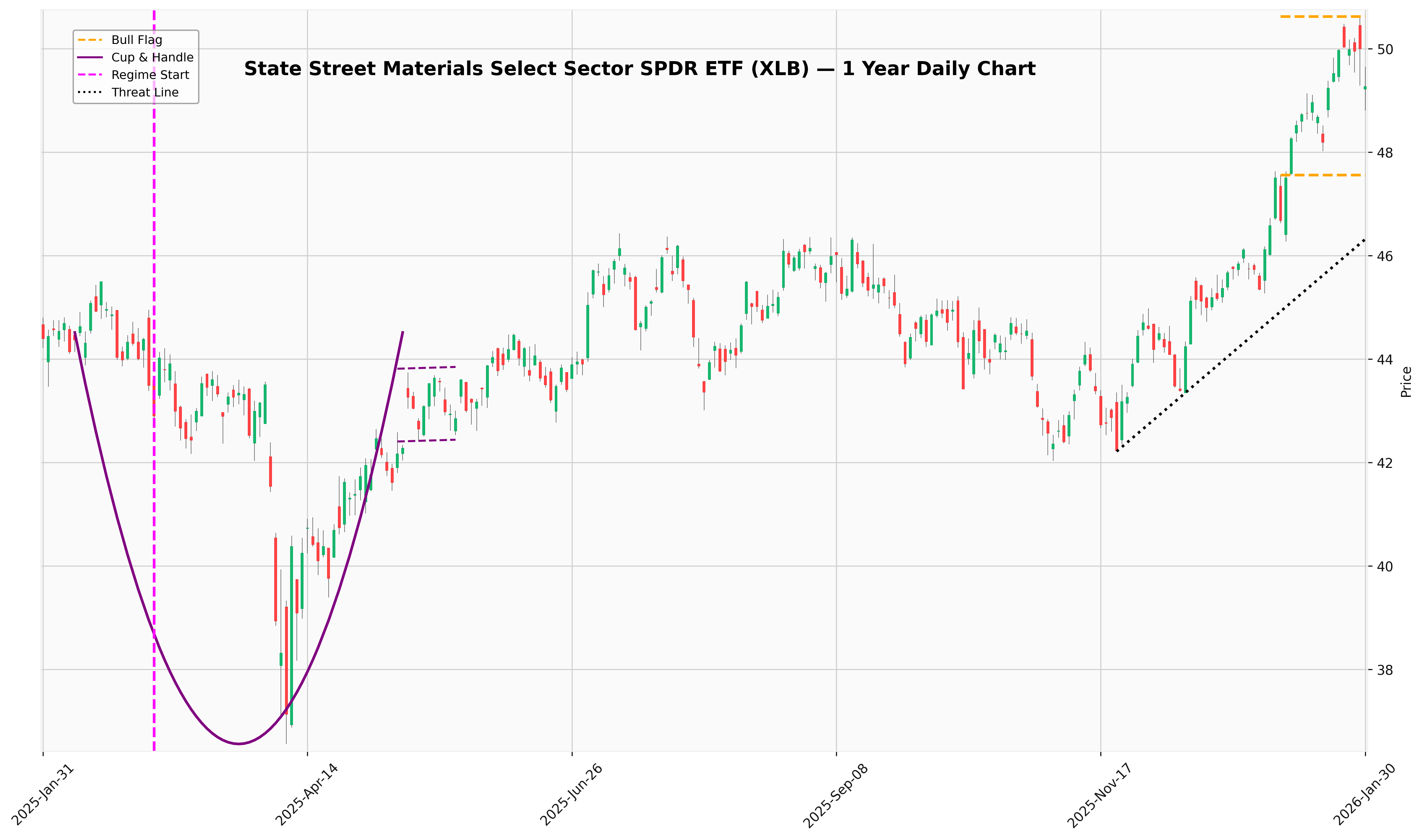

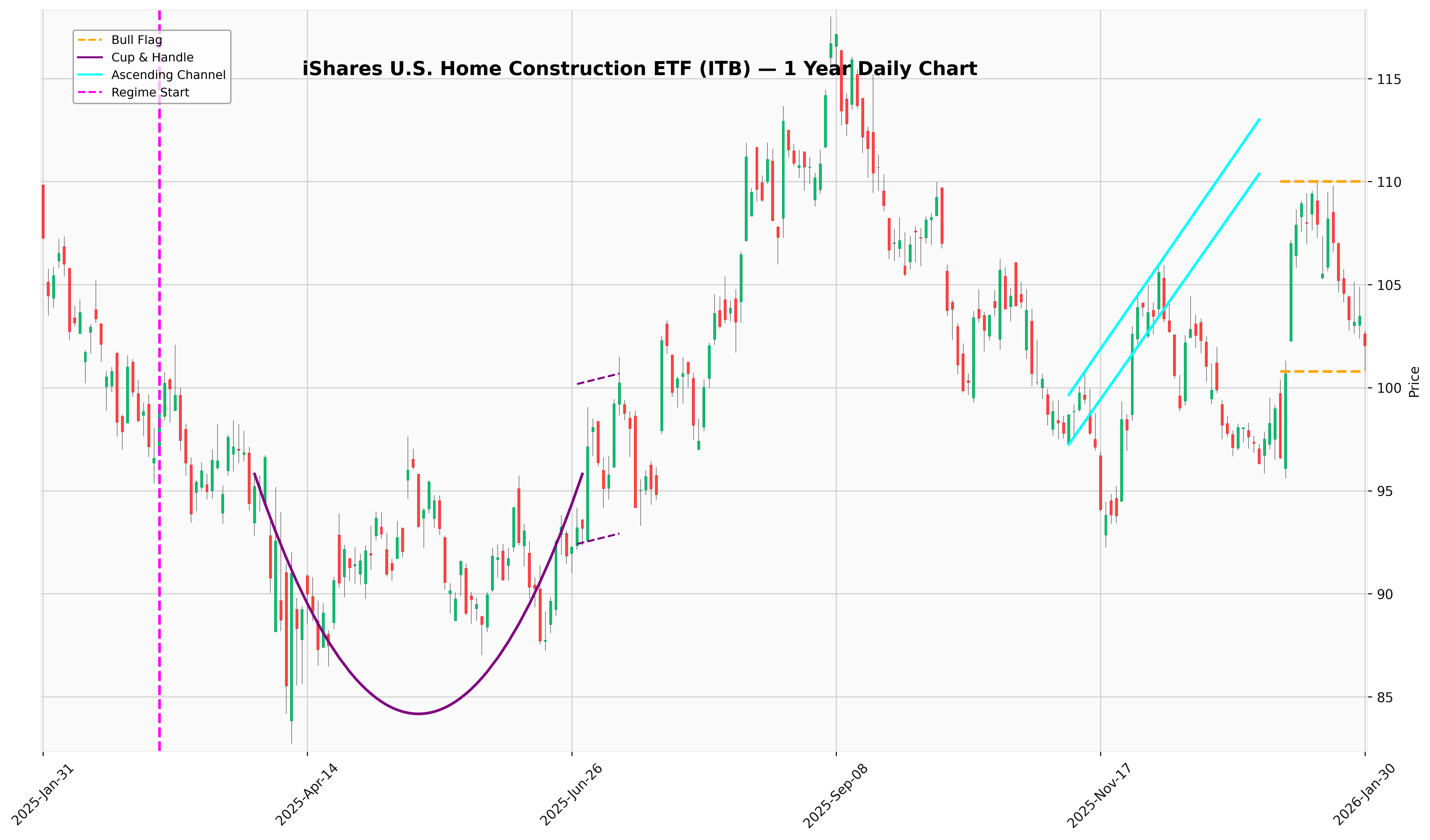

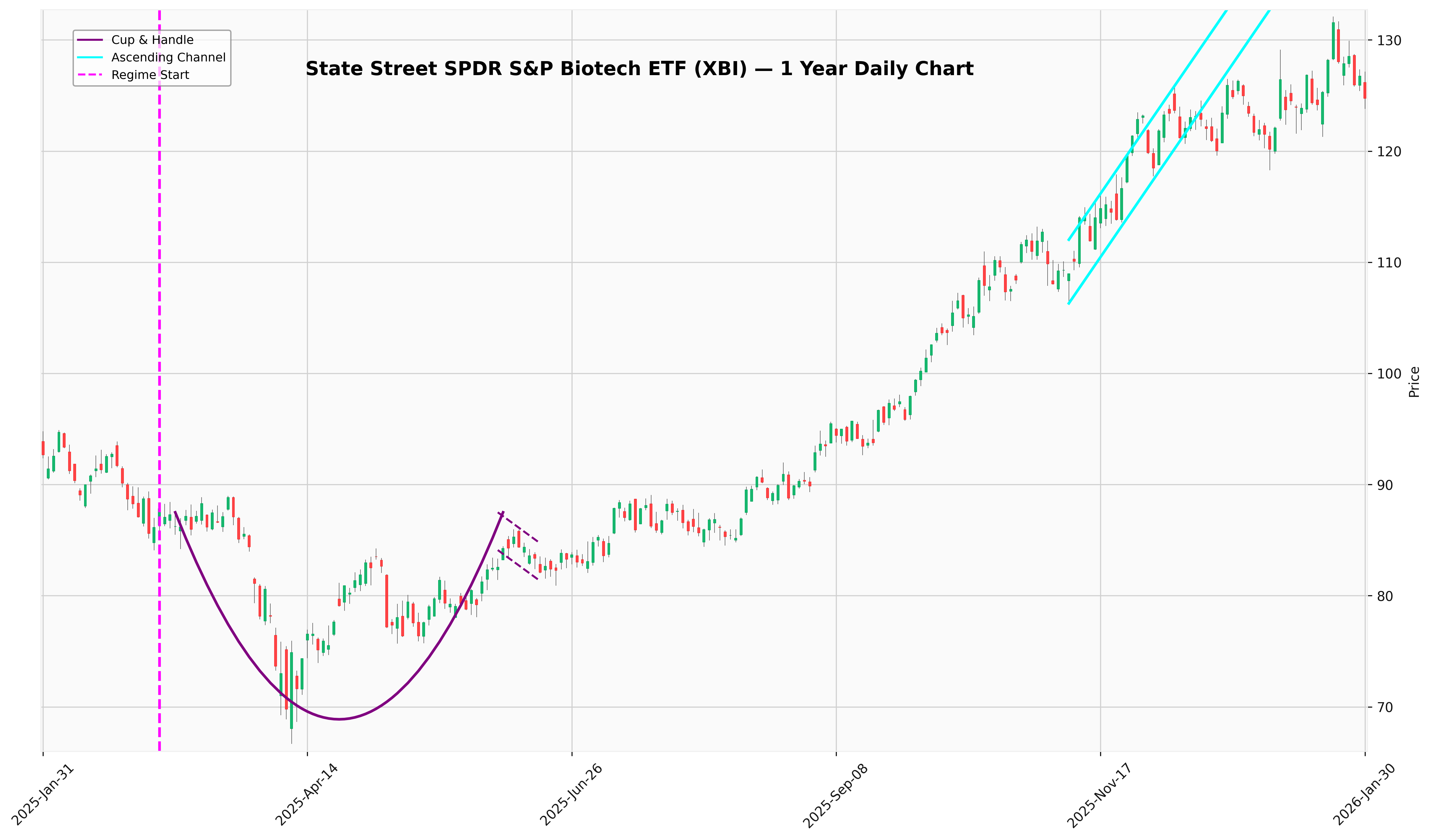

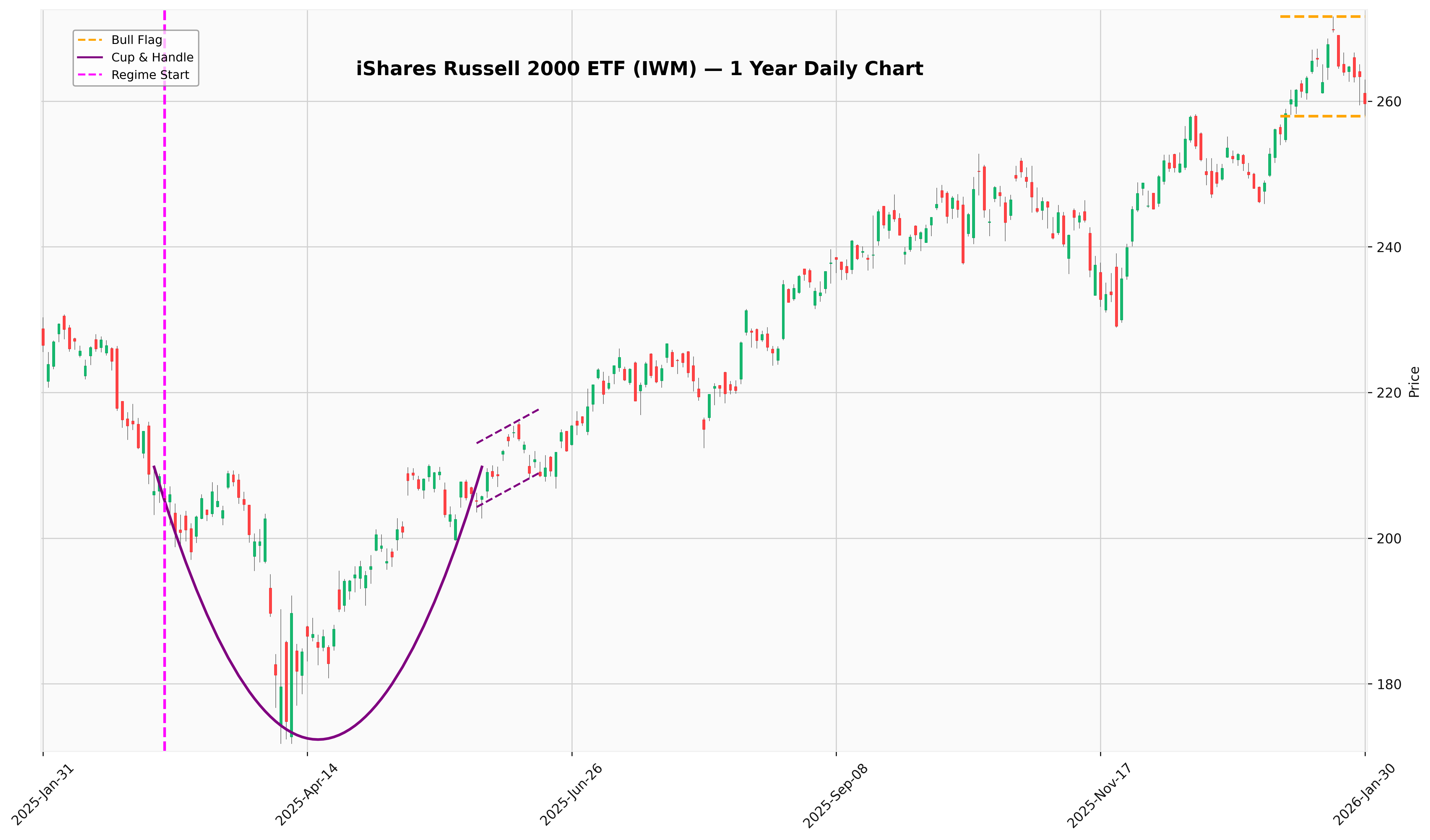

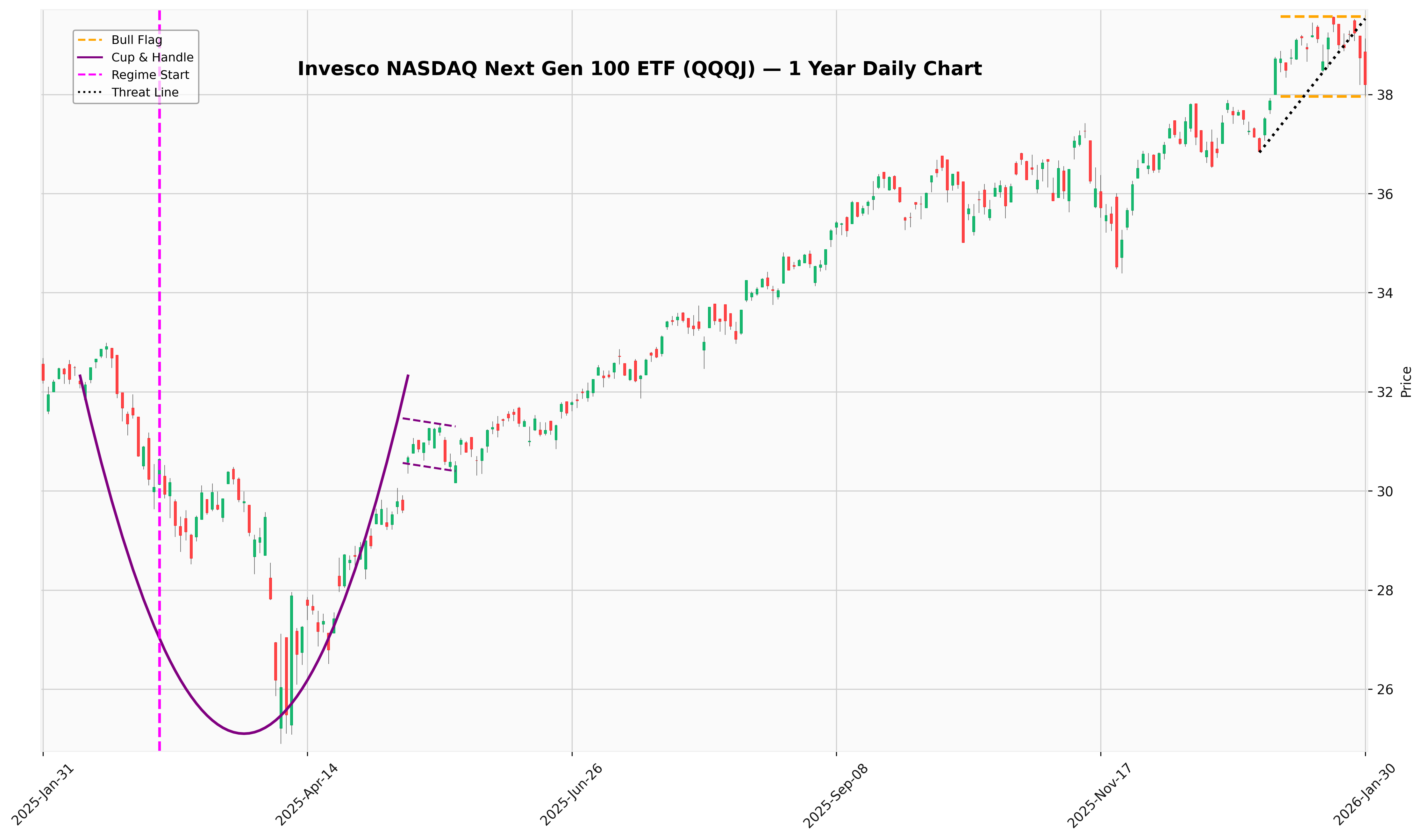

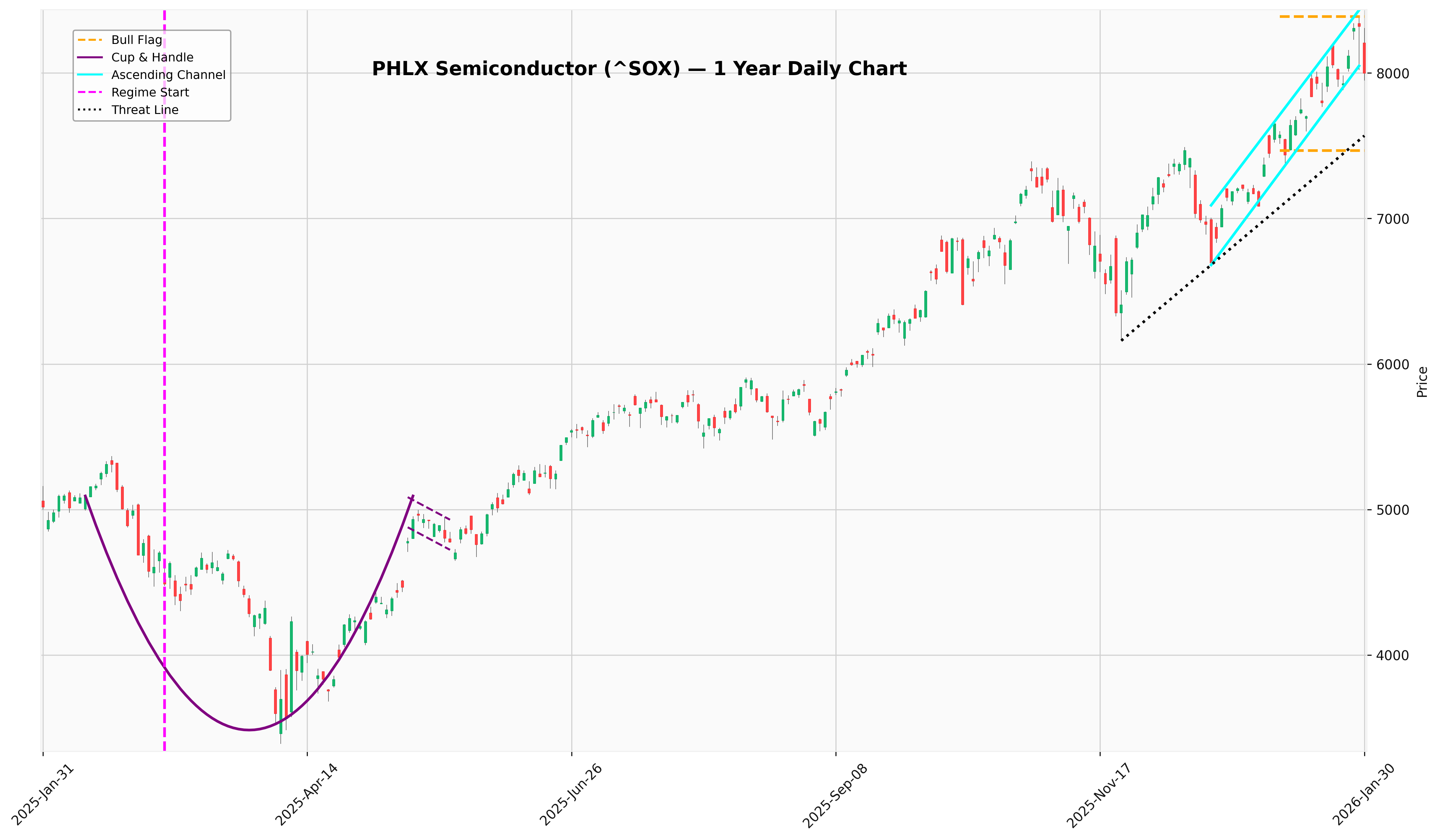

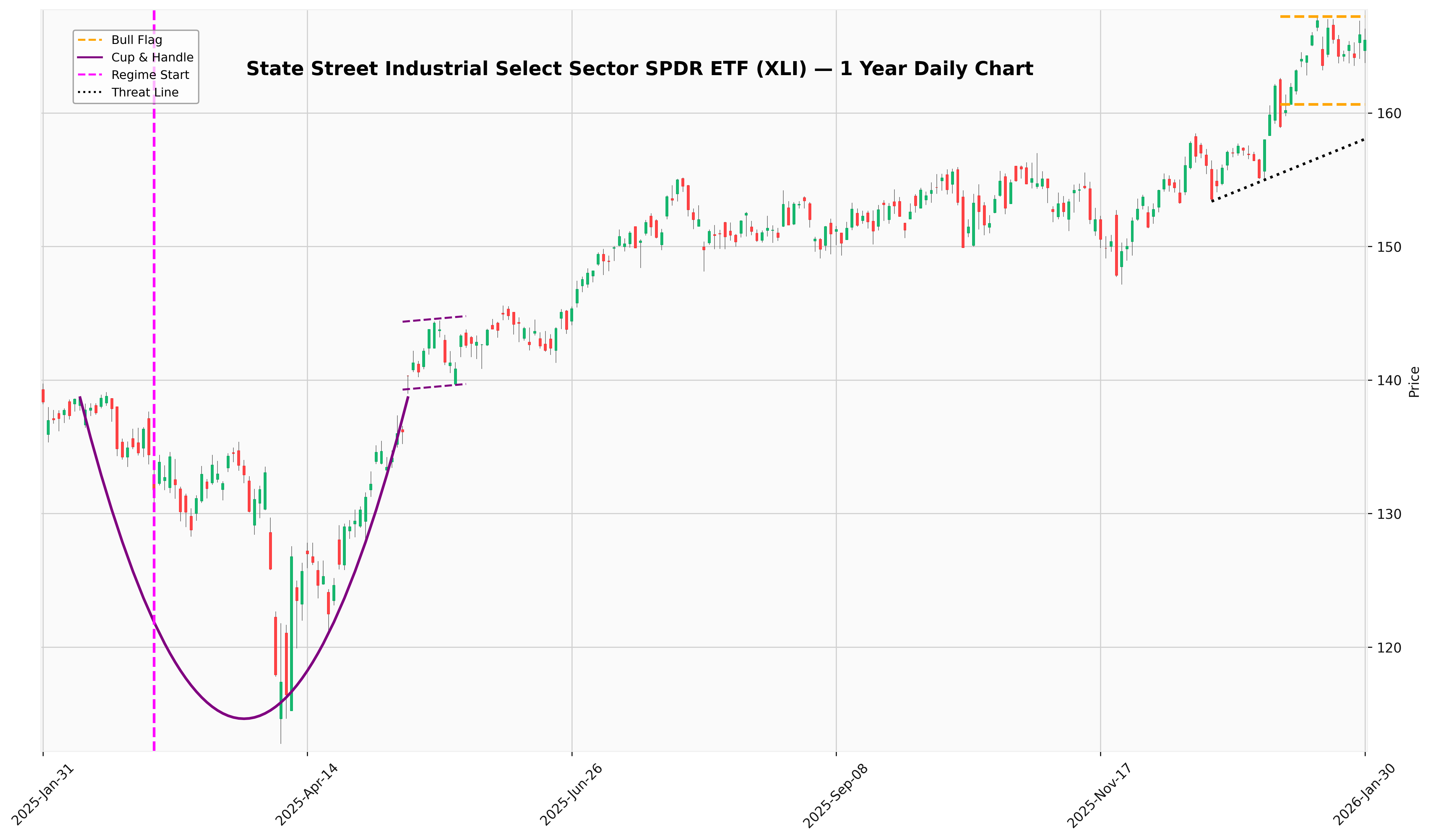

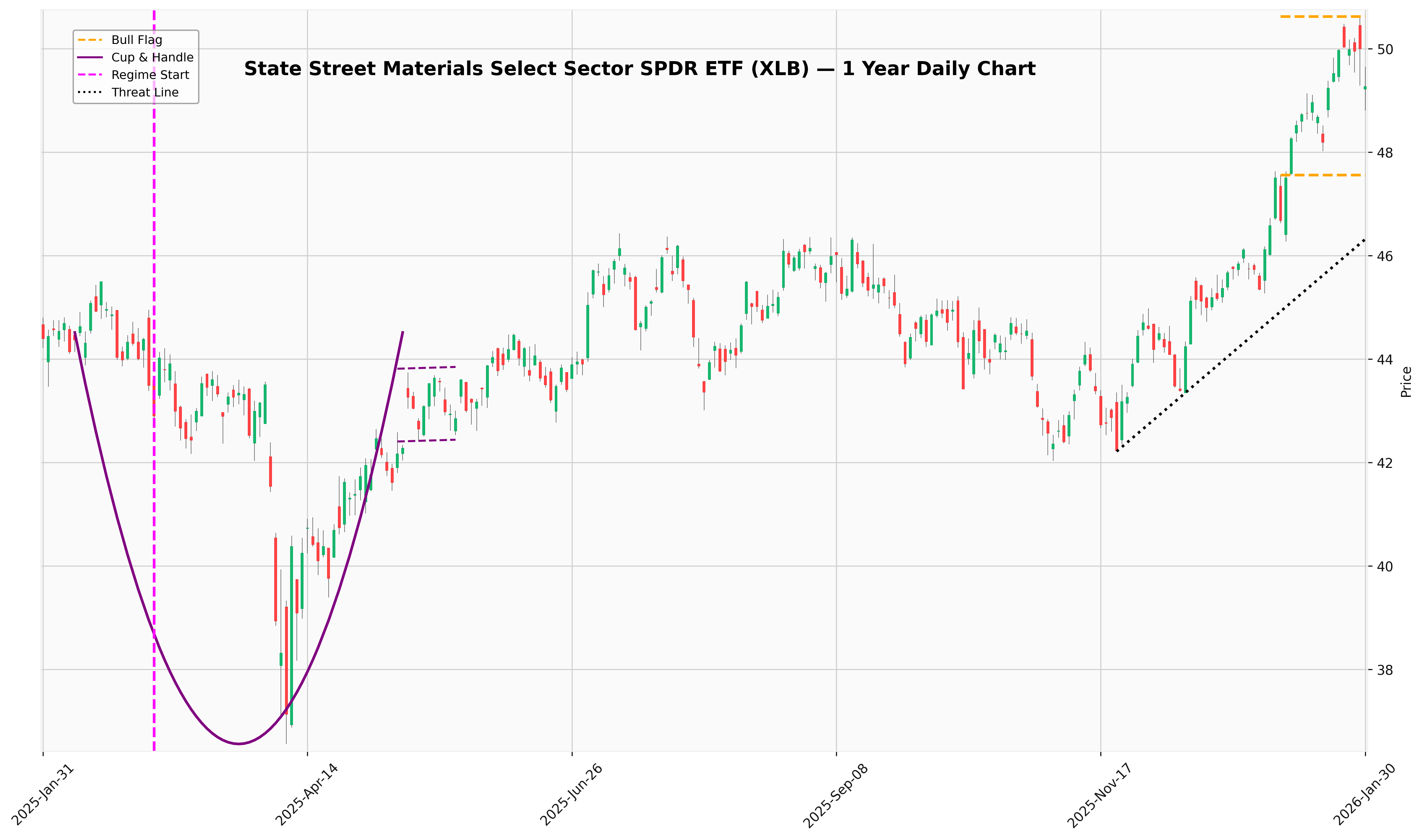

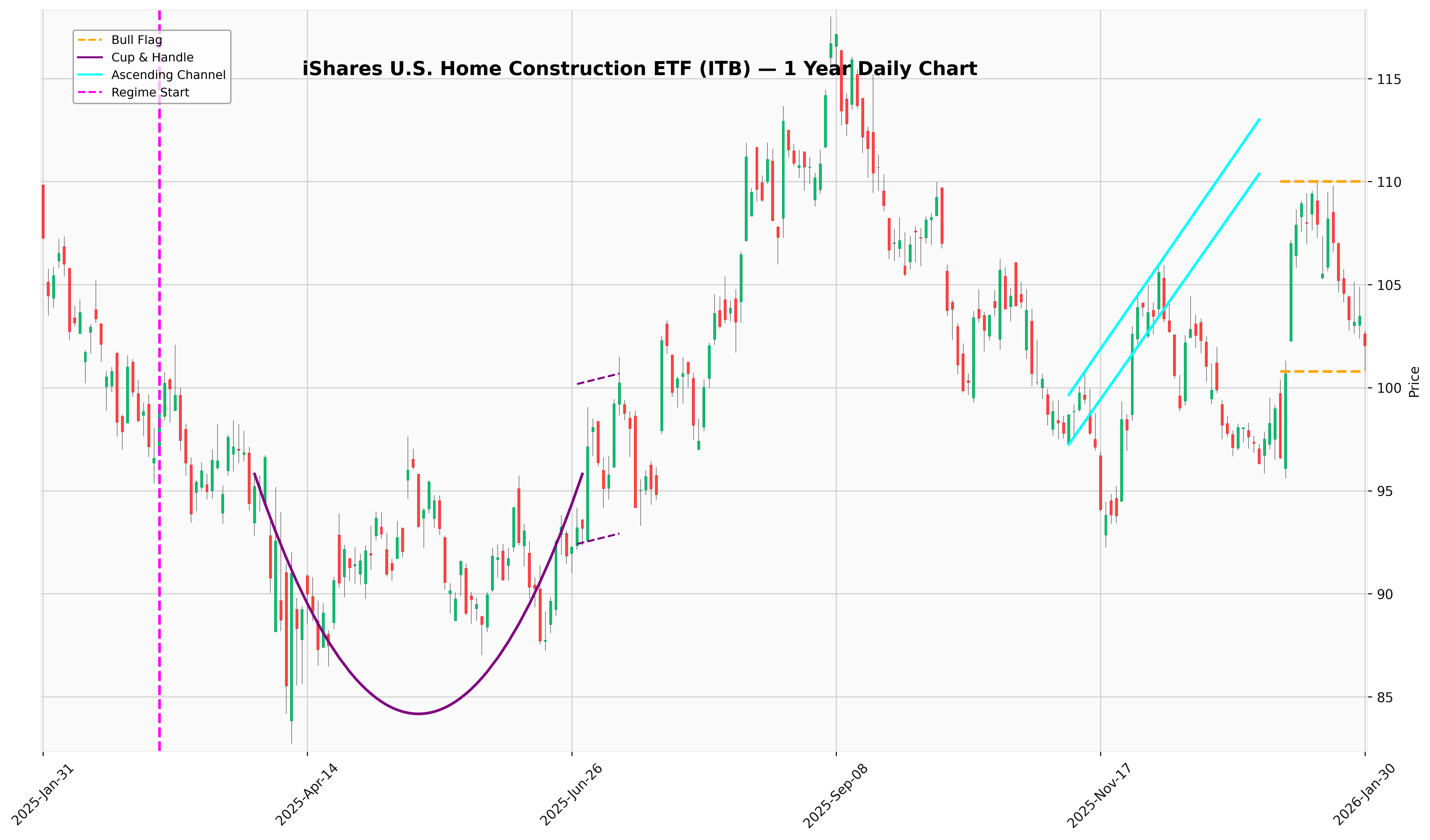

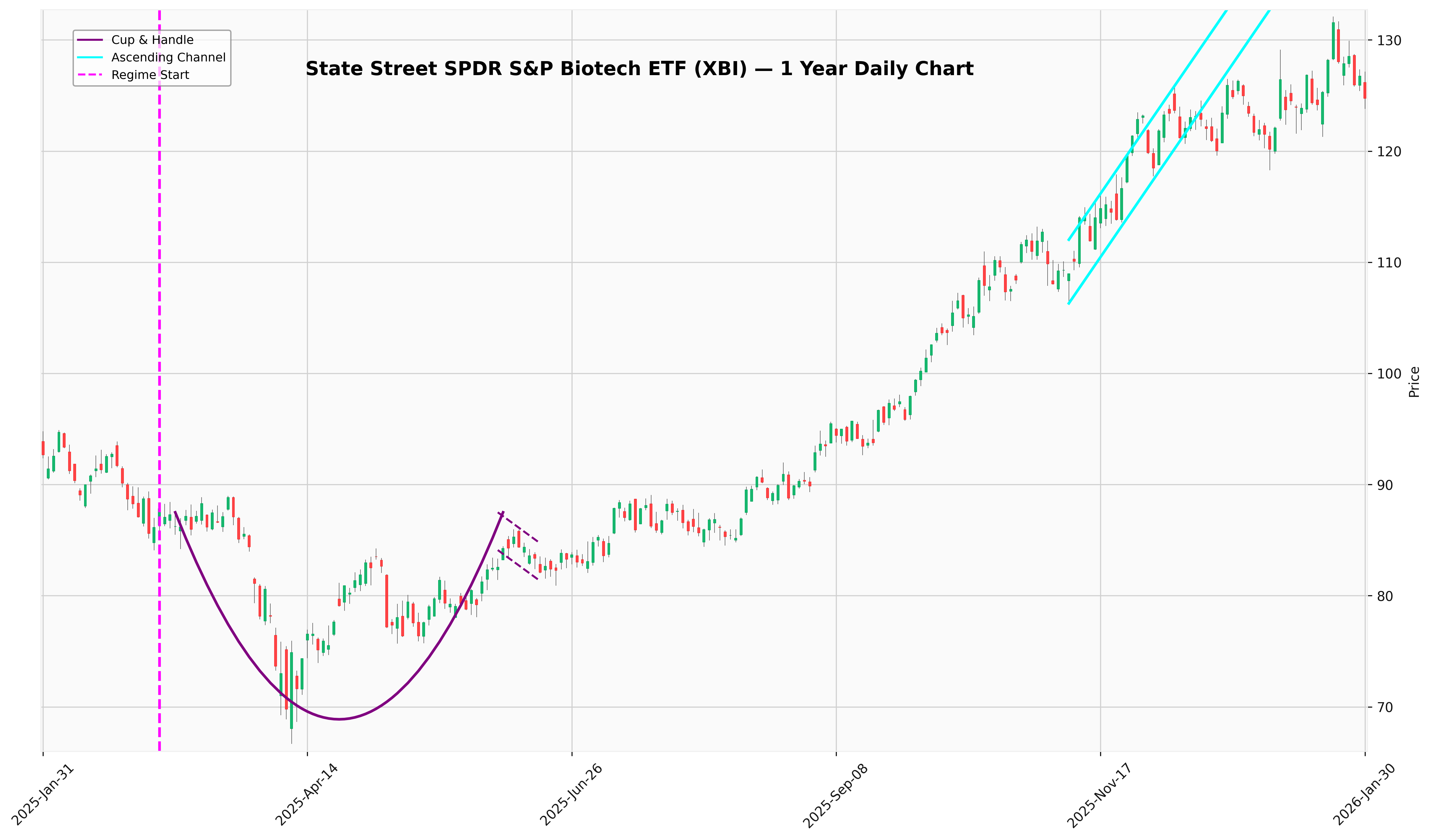

Short-term continuation patterns that form after a sharp price move. They typically represent brief pauses before the prevailing trend resumes.

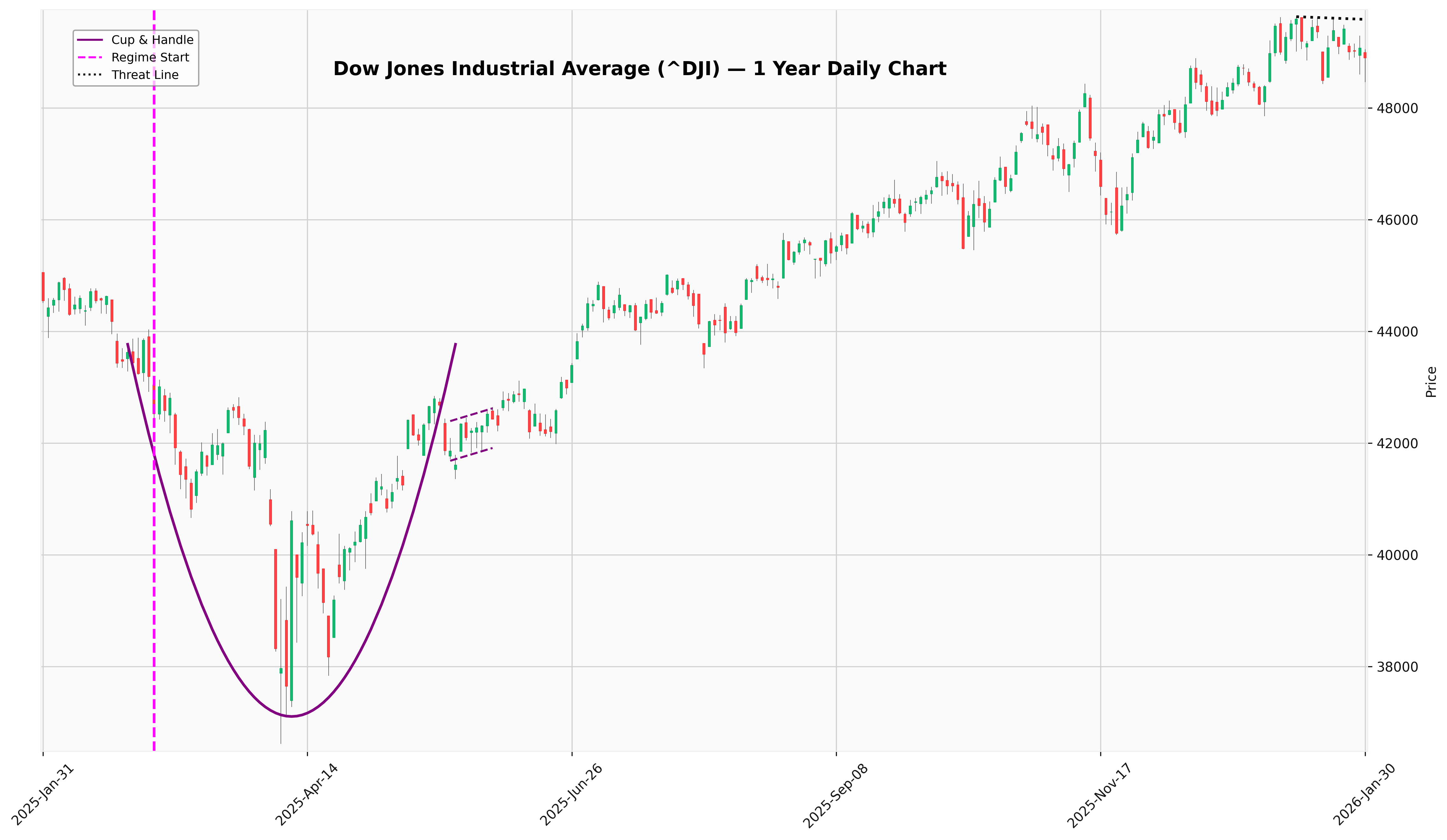

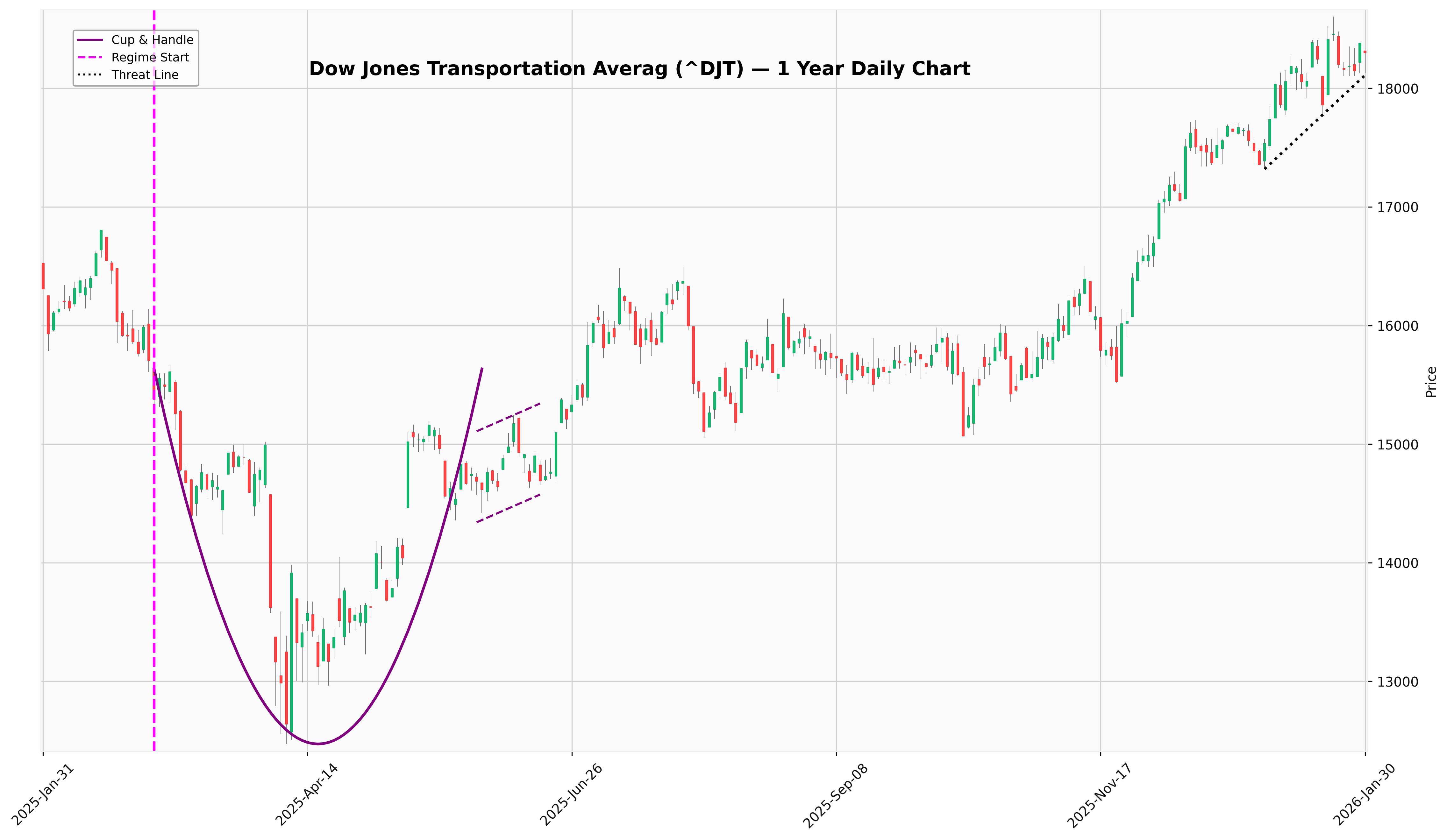

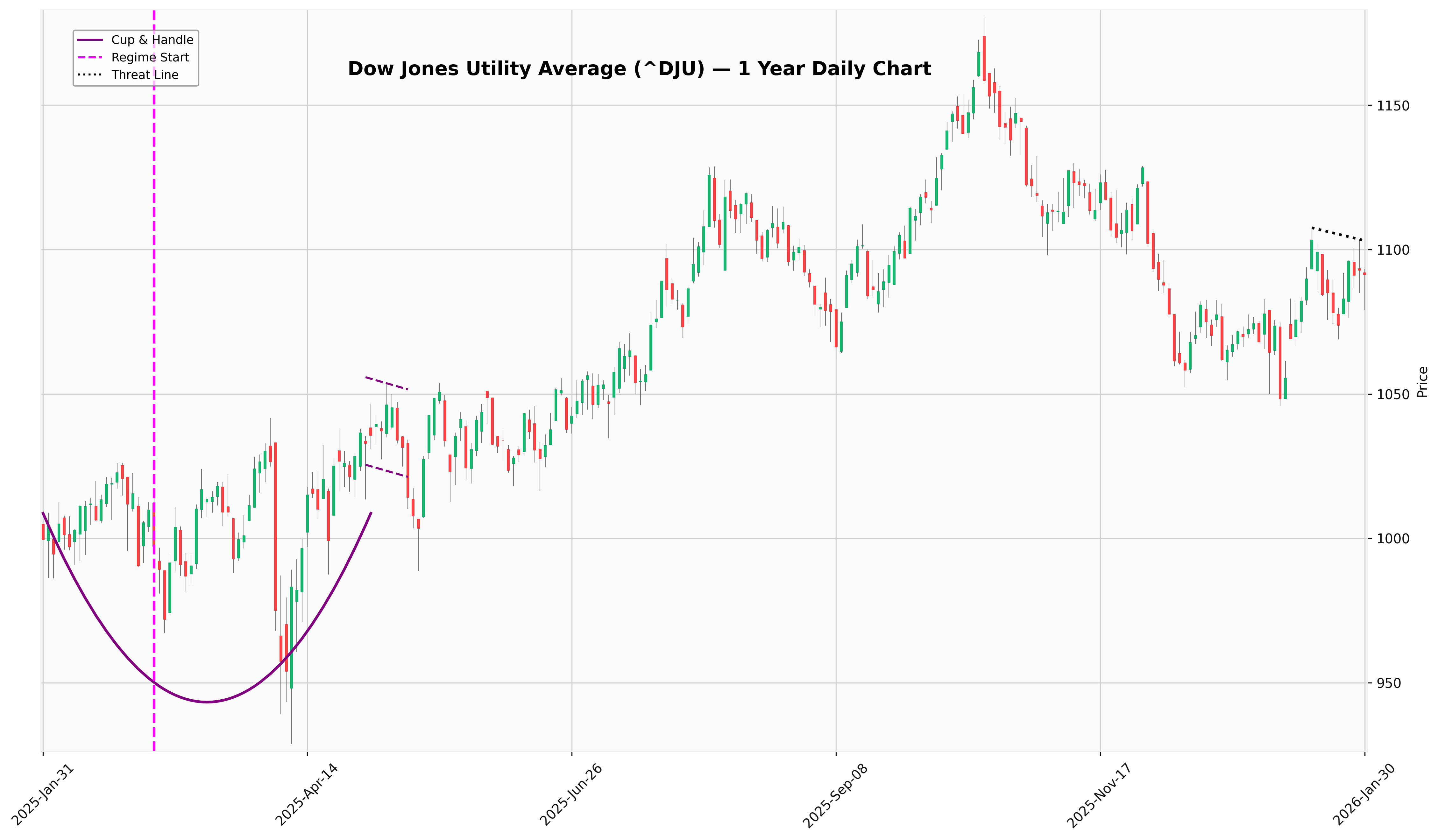

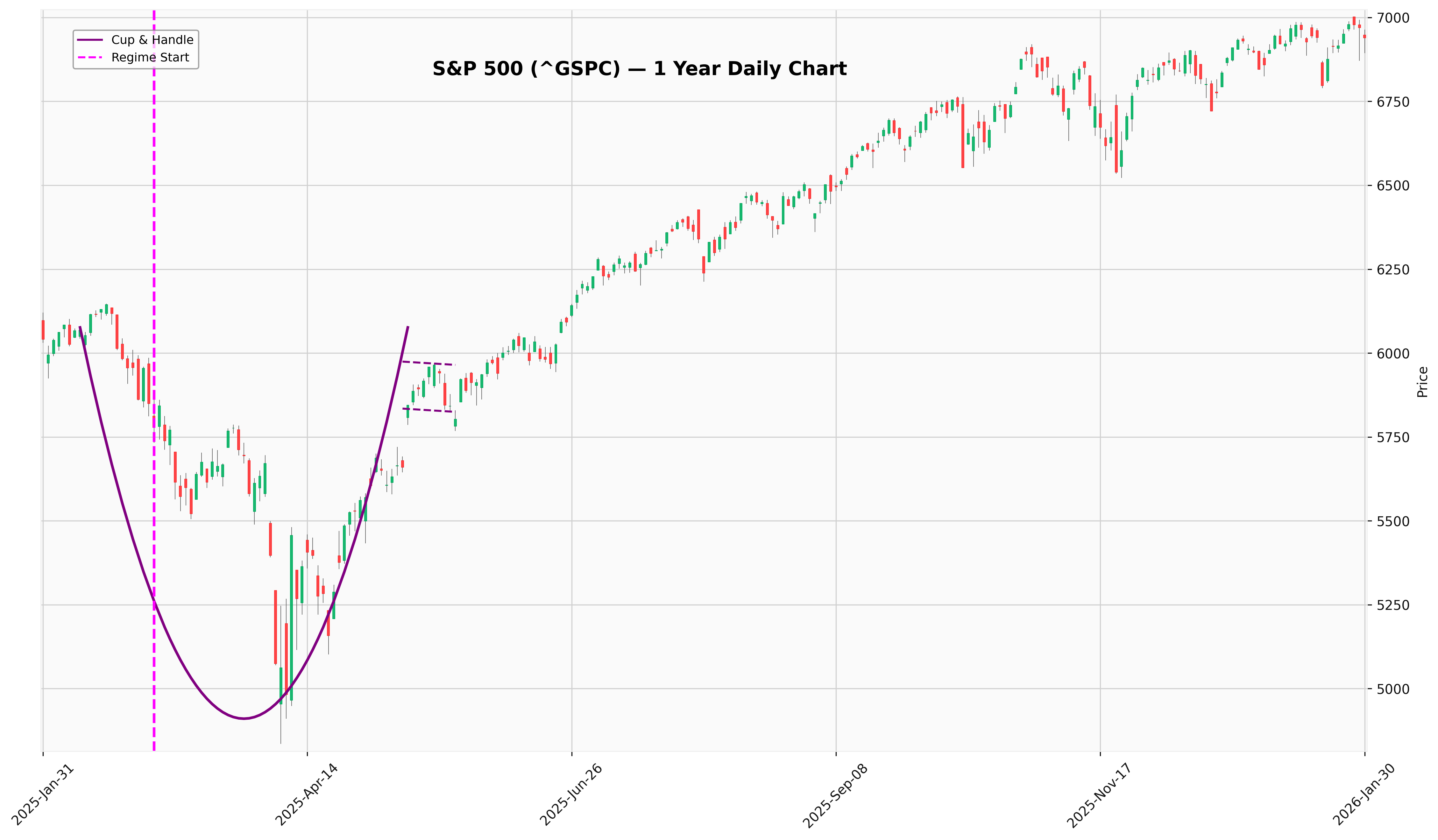

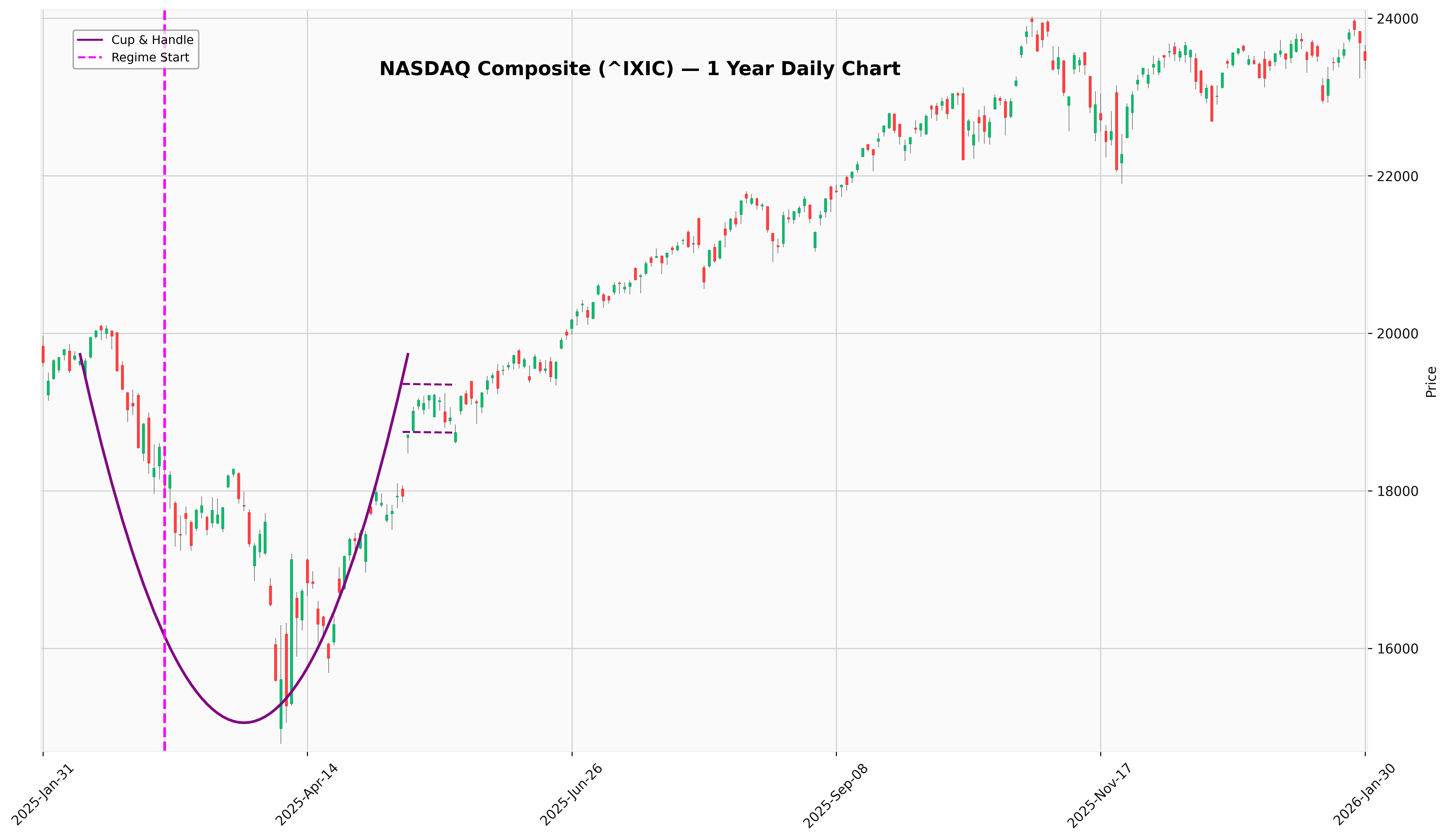

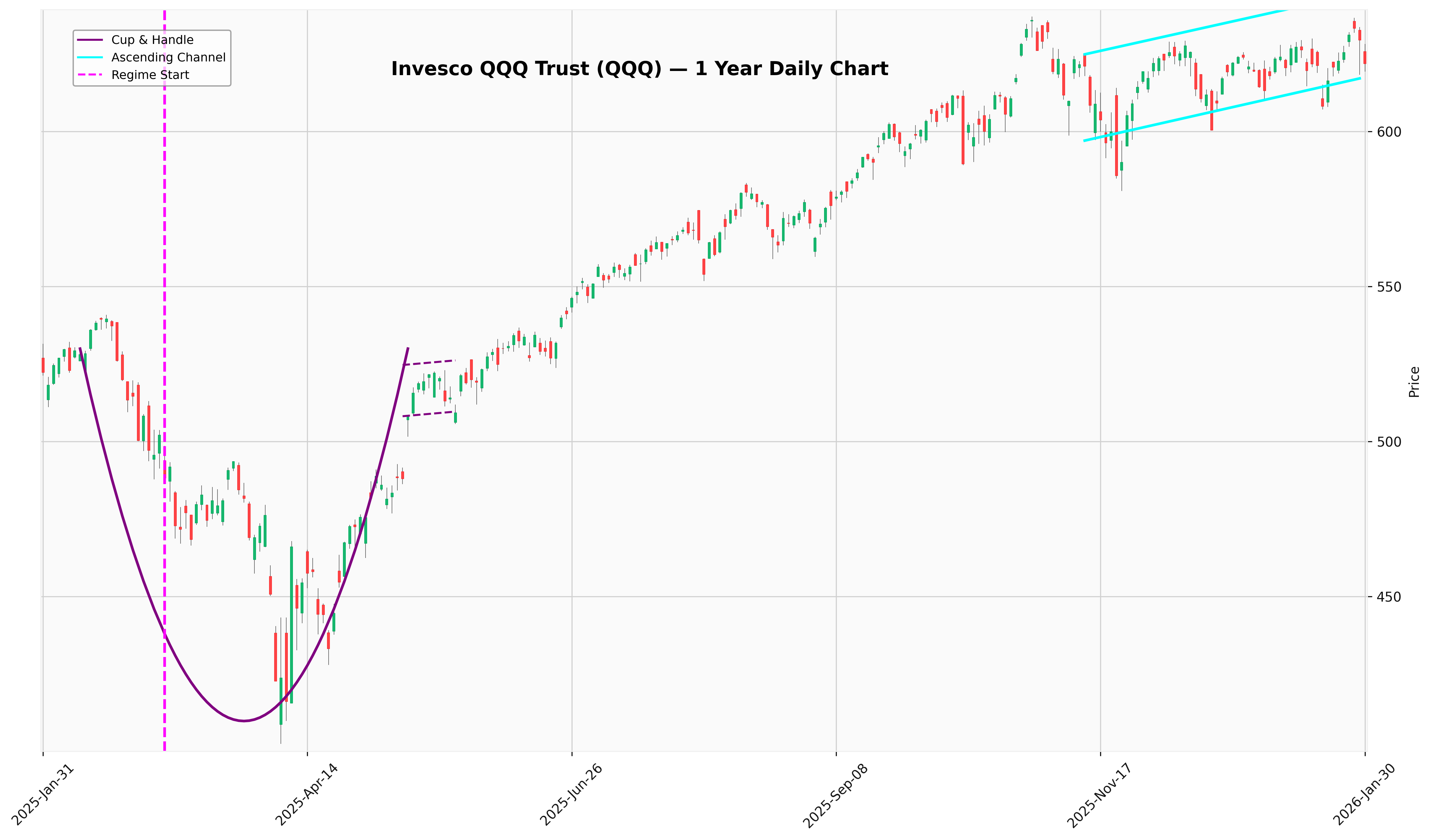

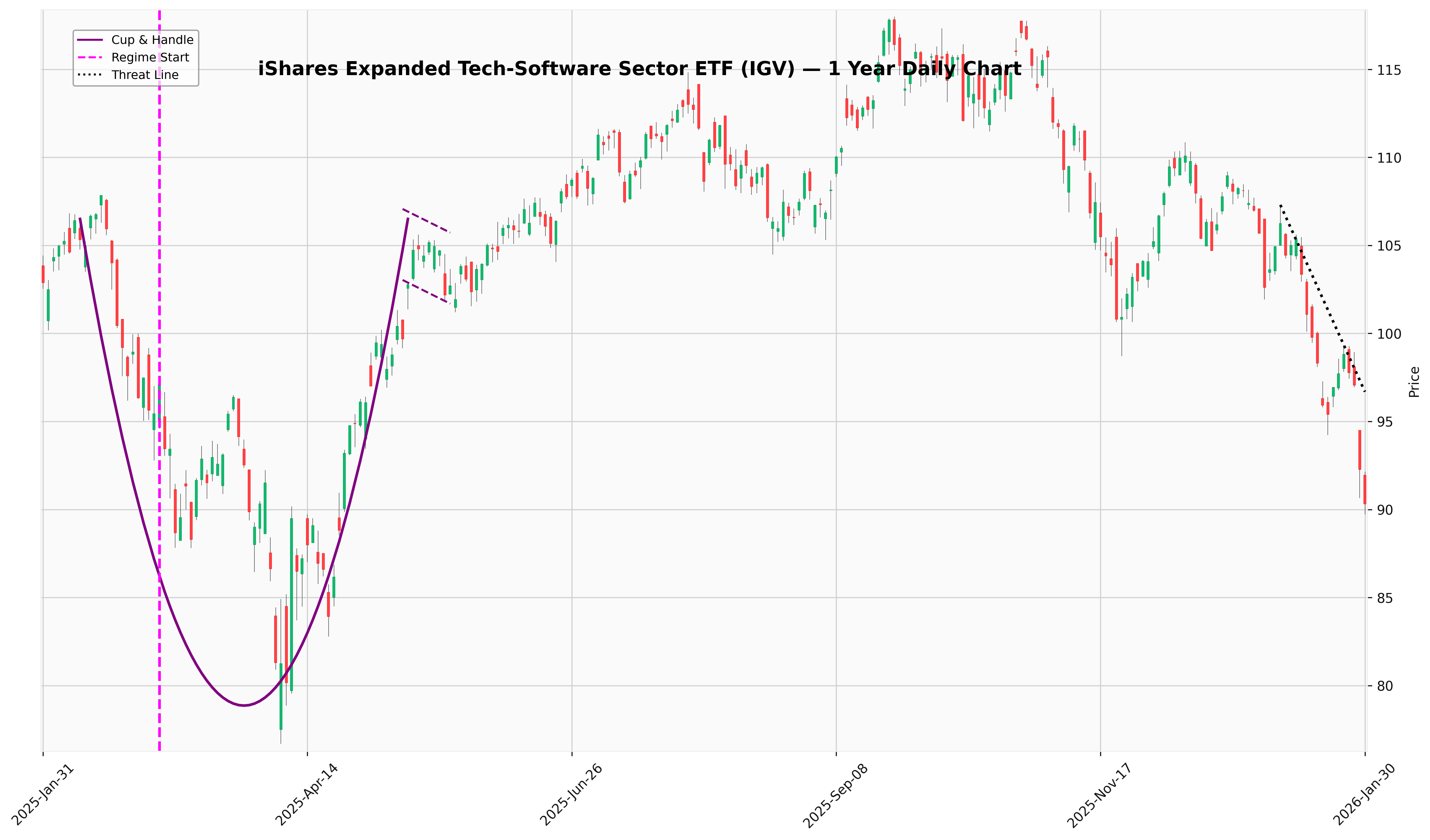

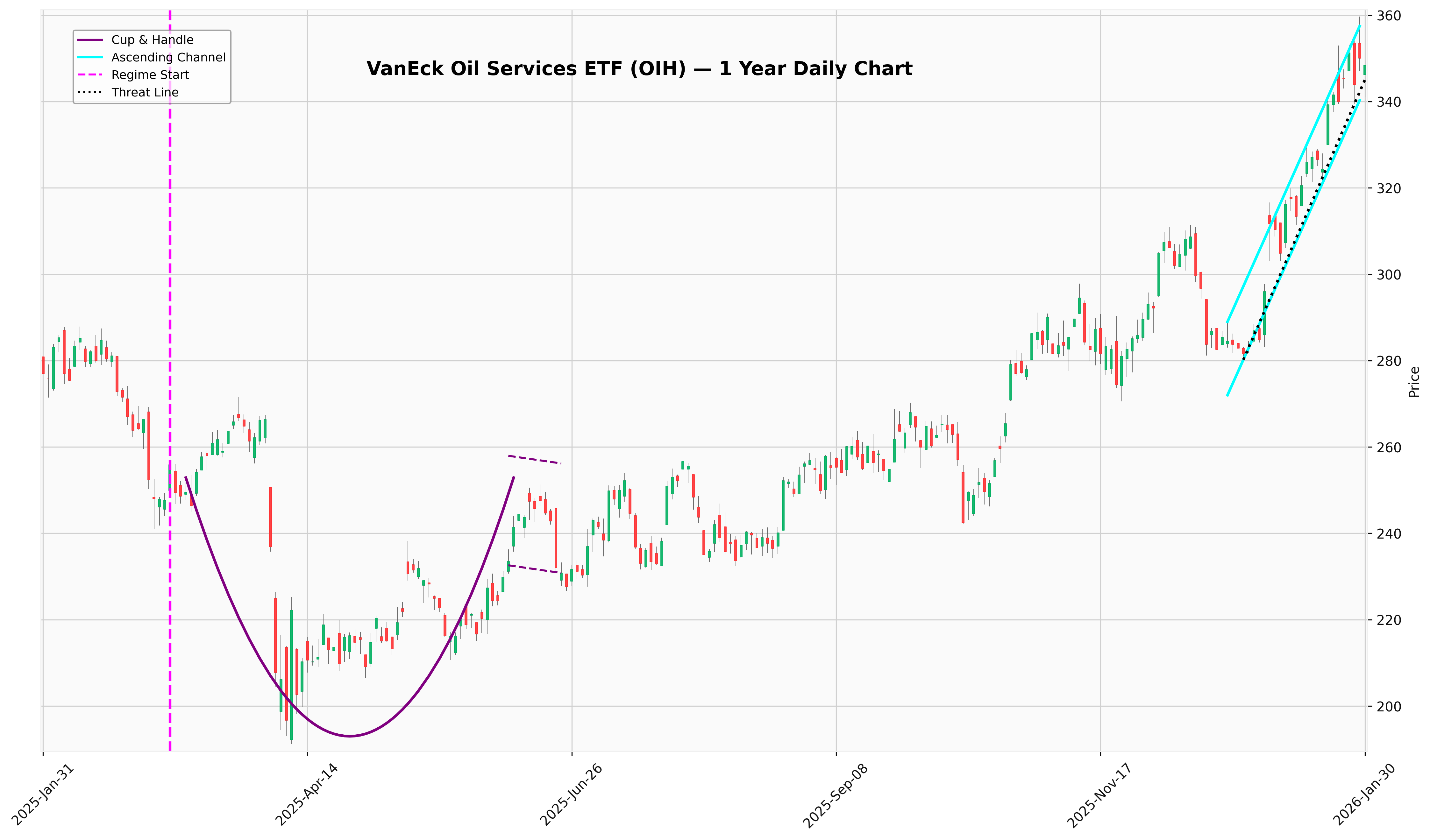

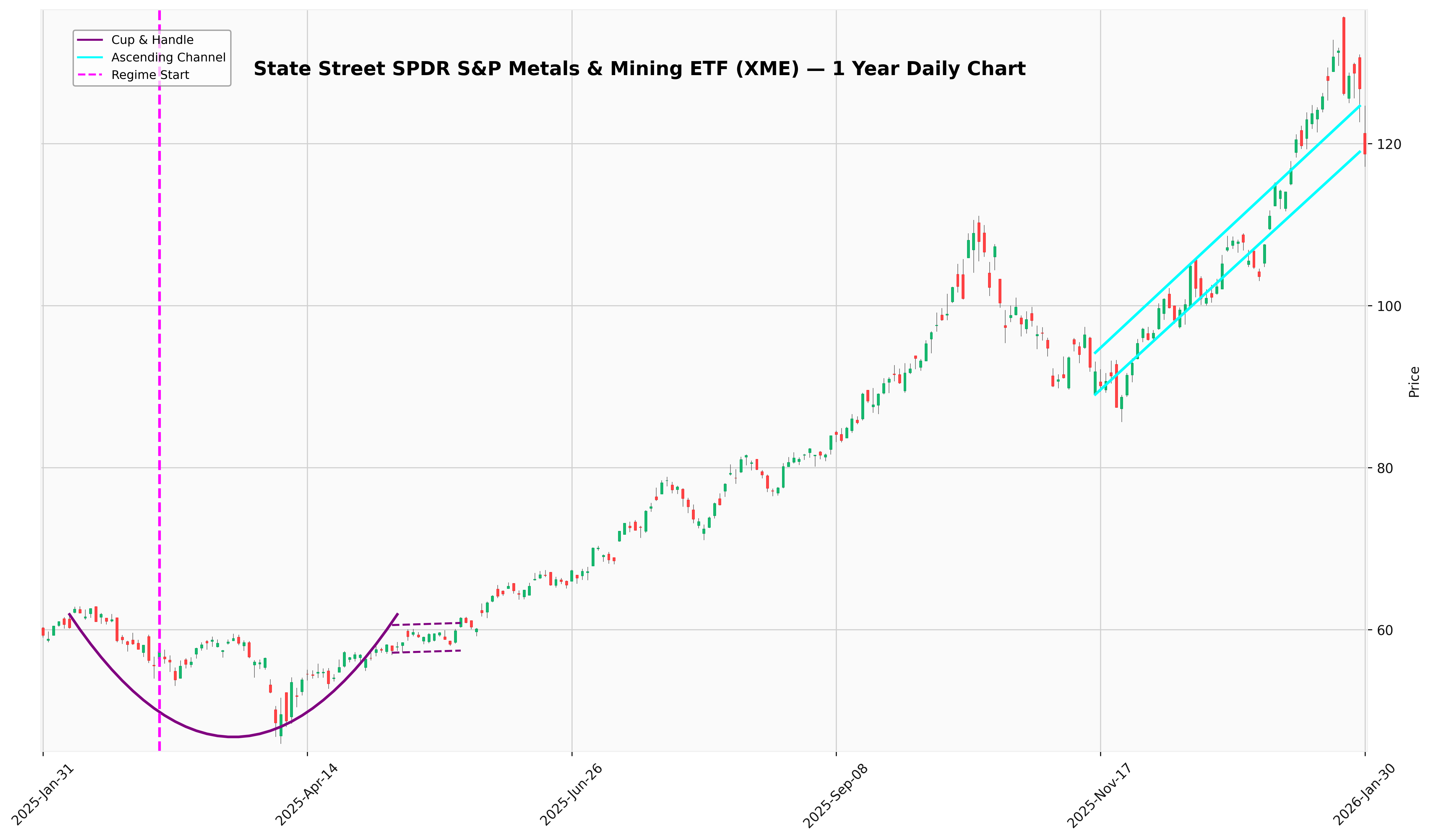

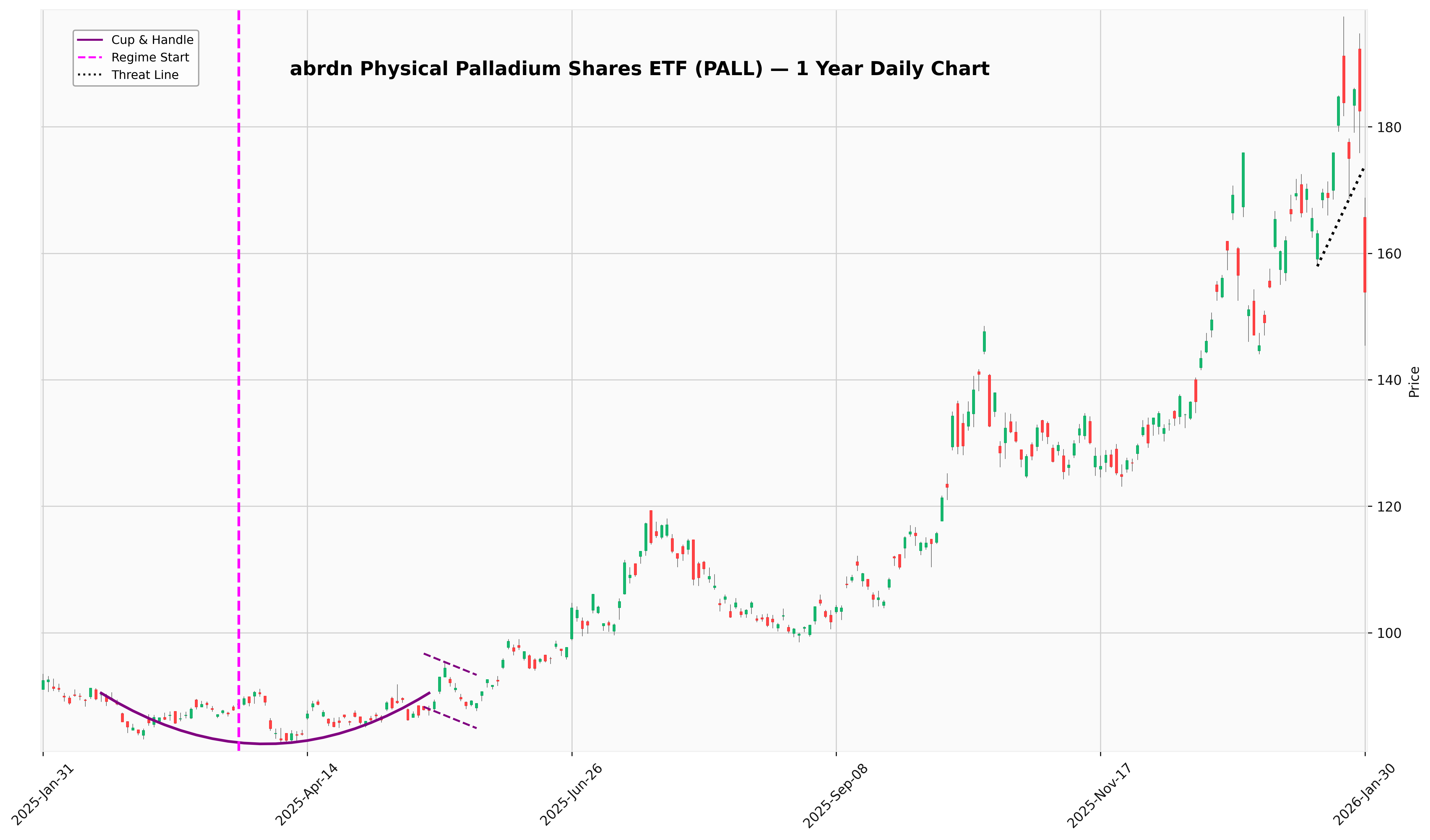

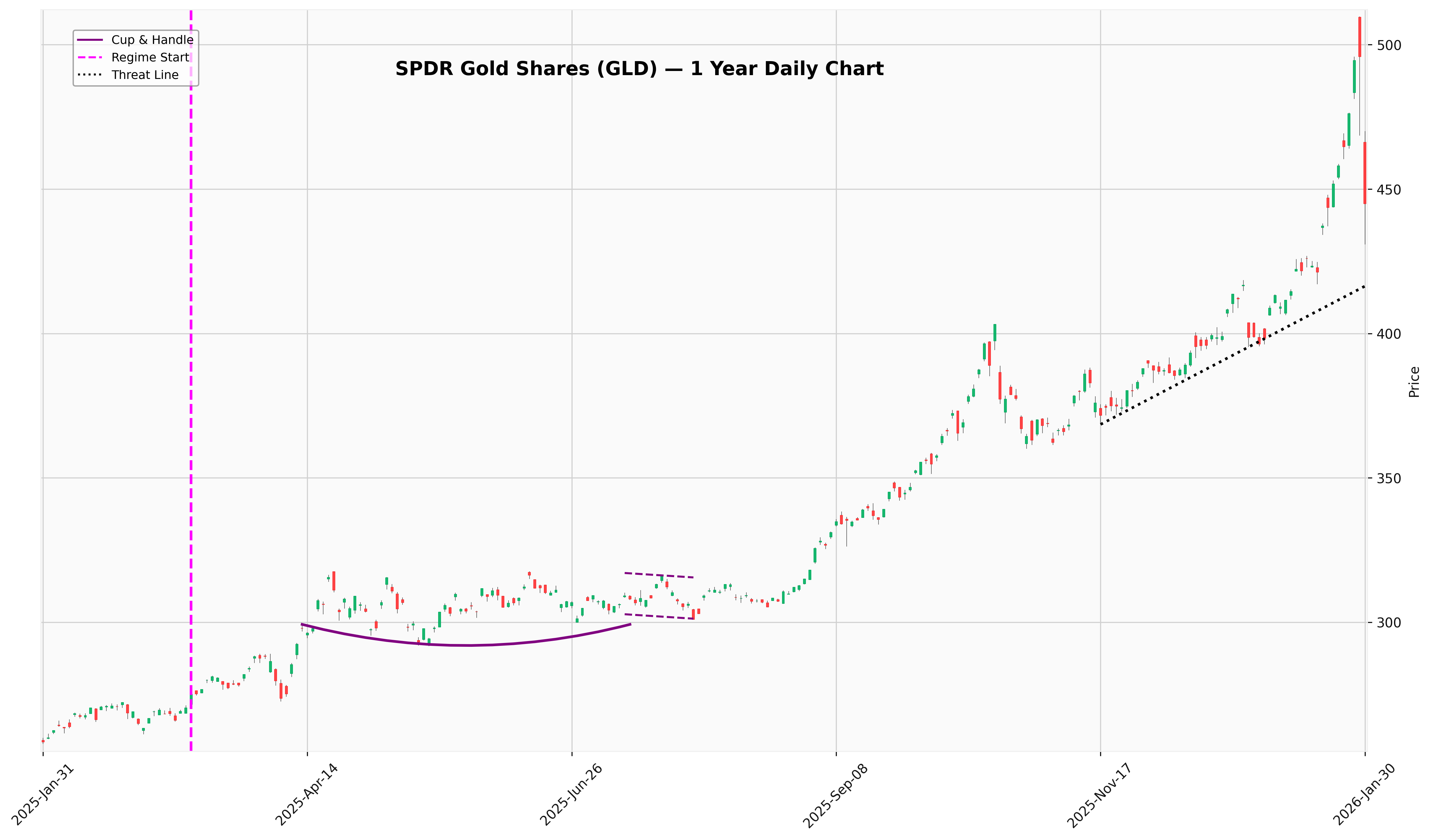

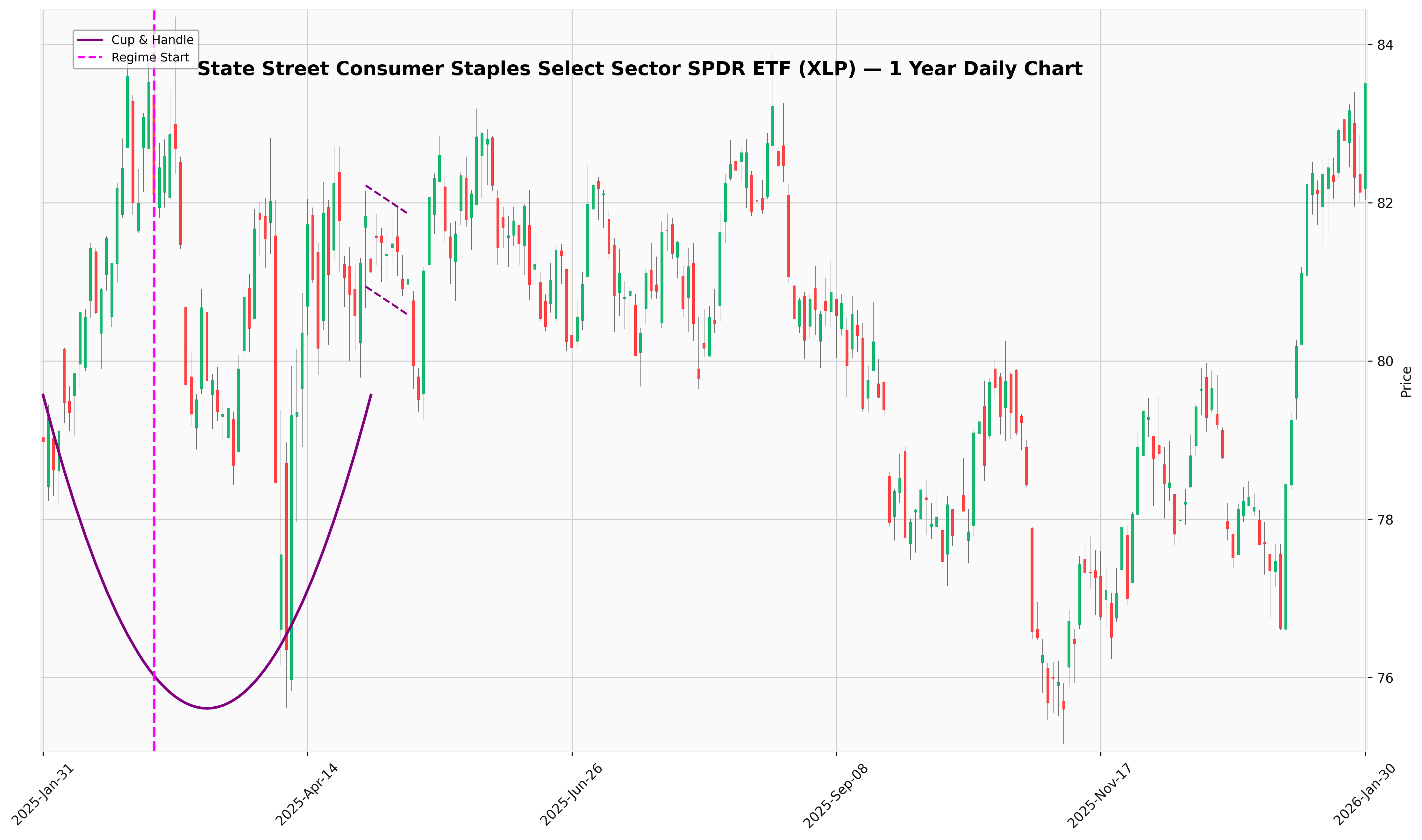

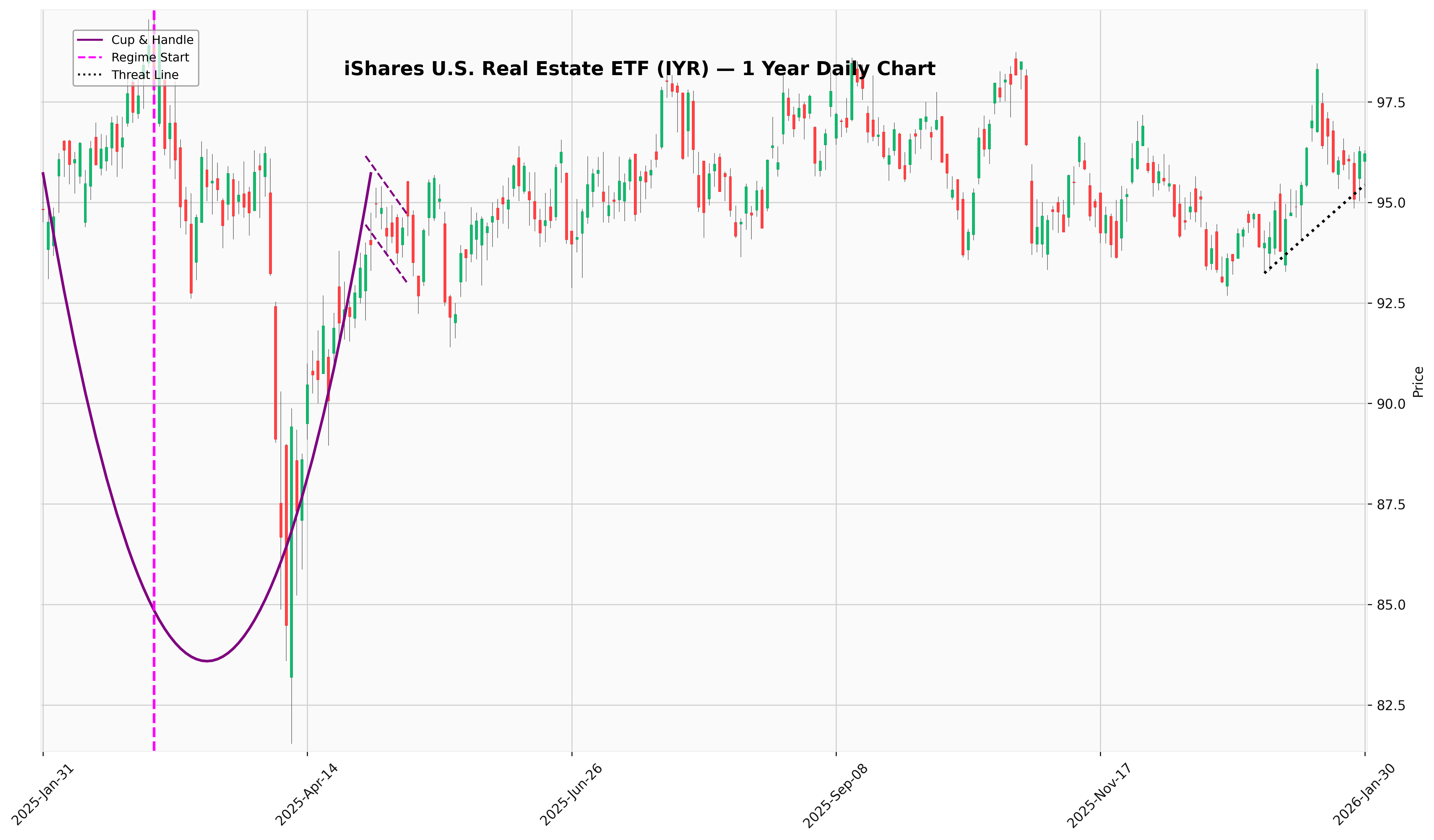

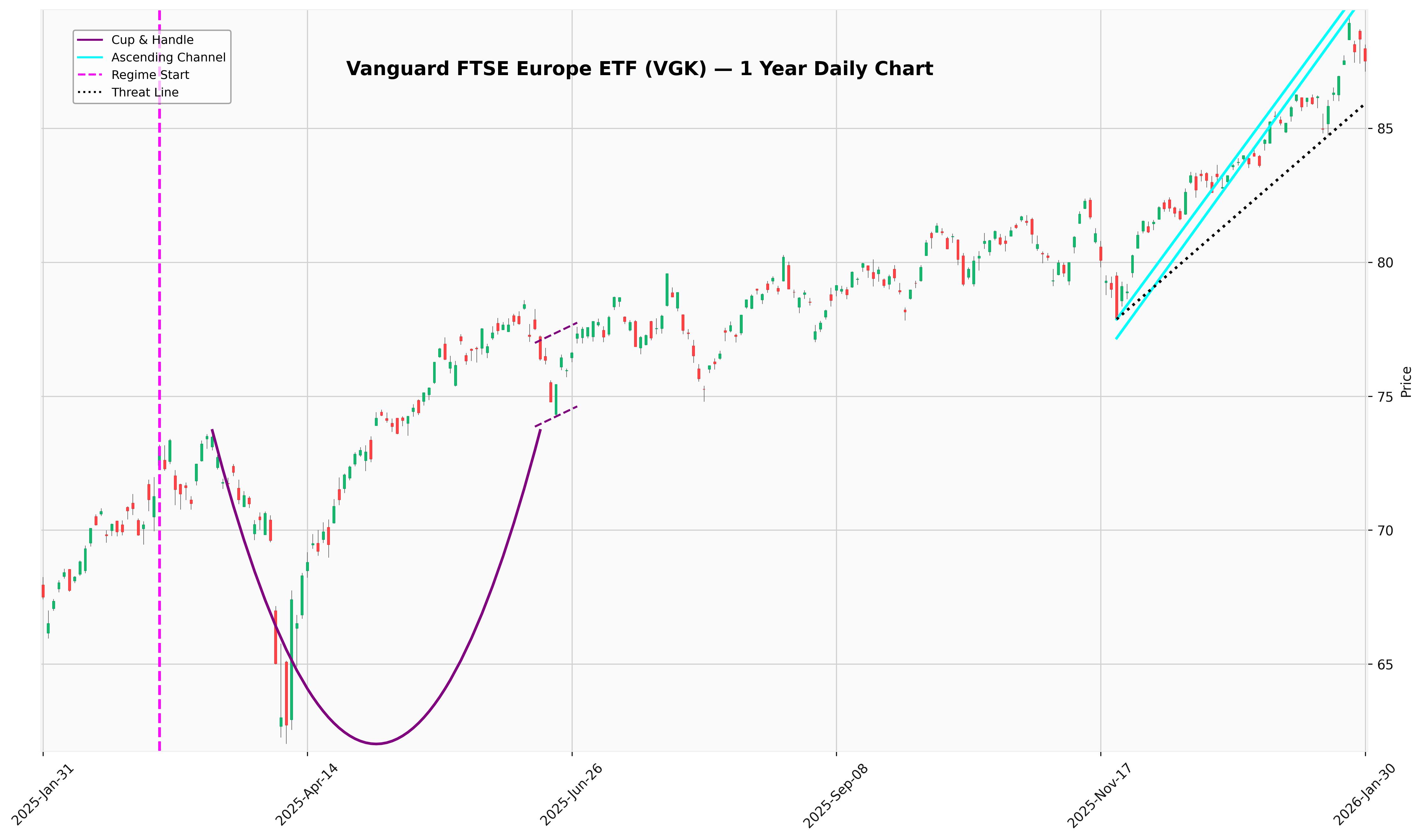

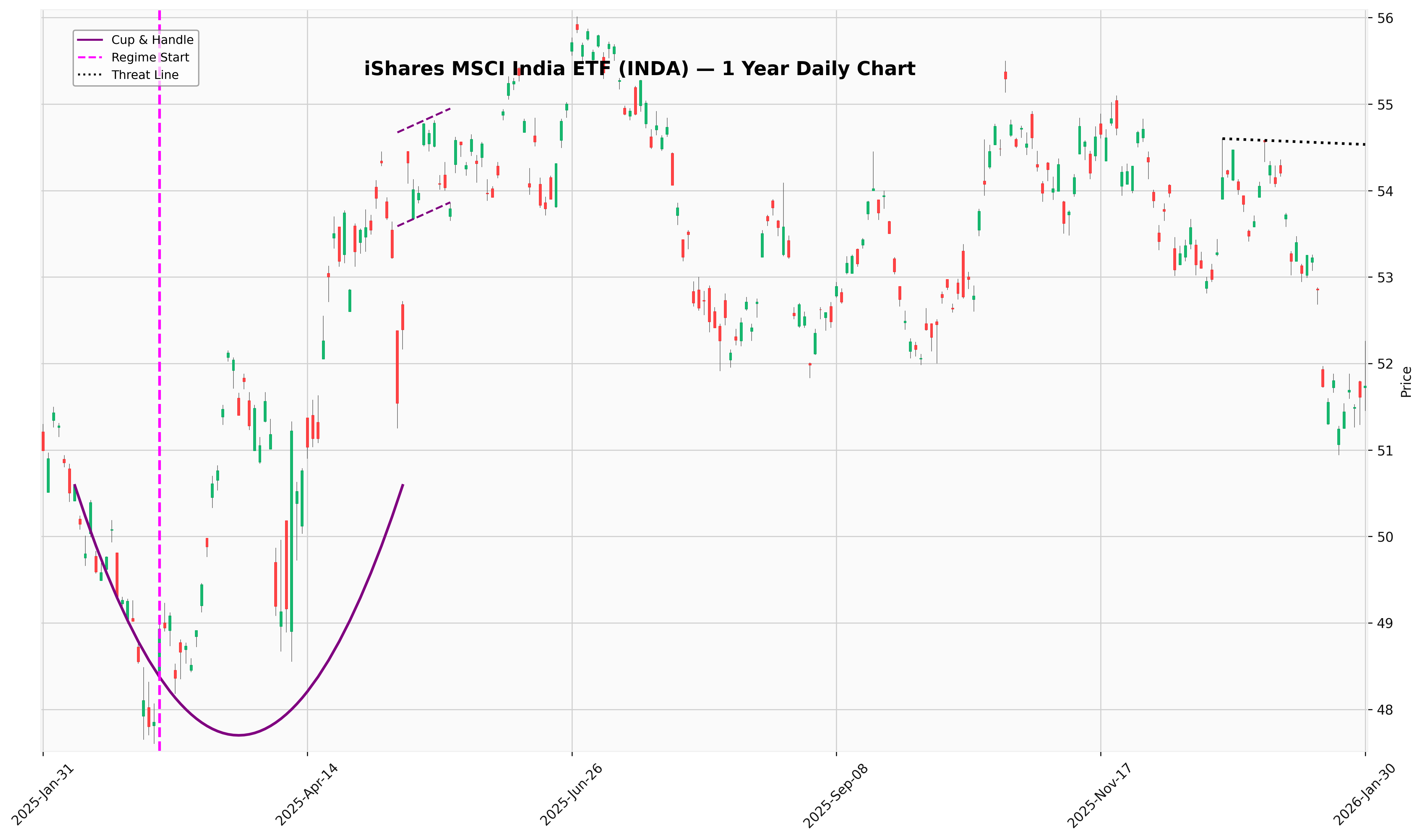

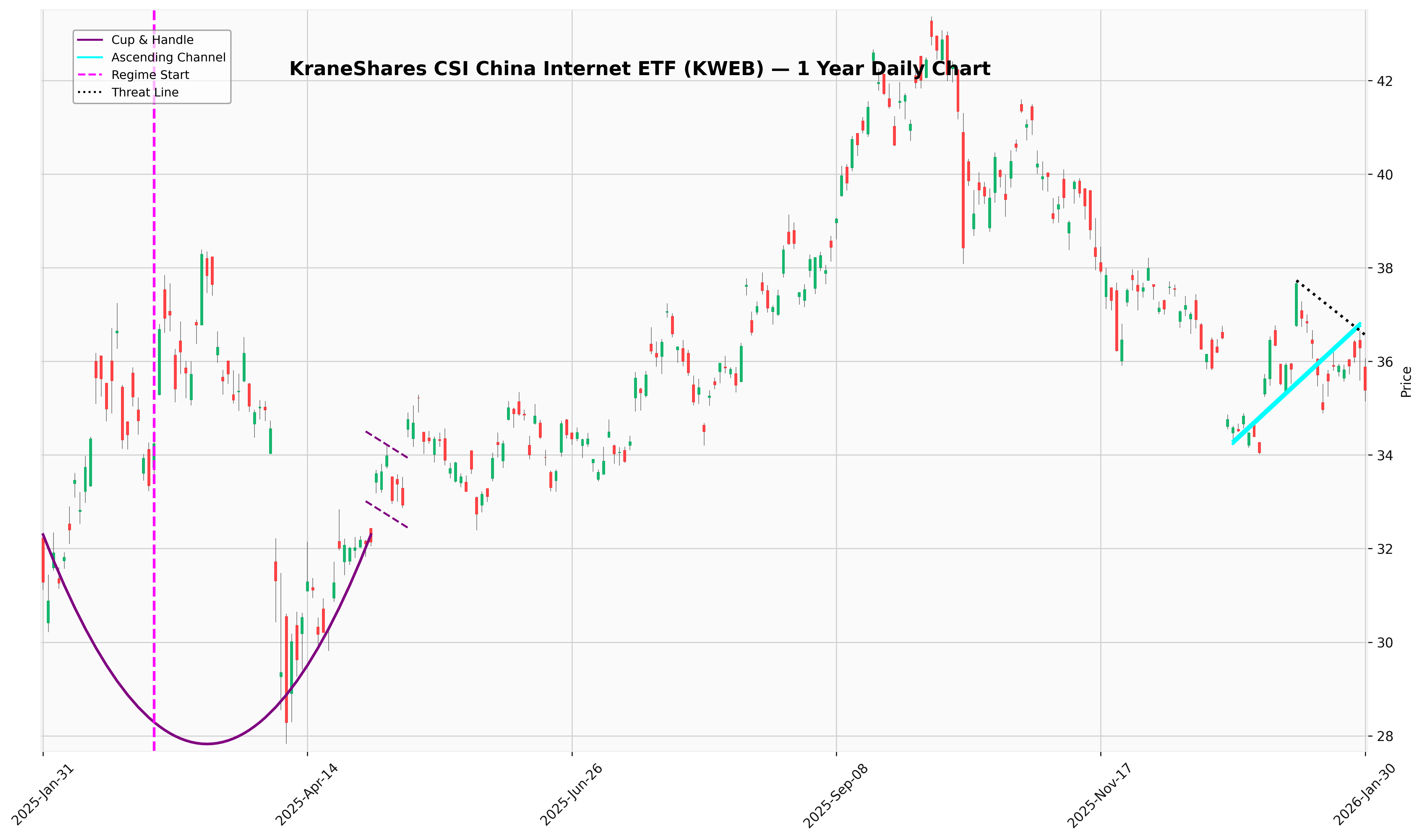

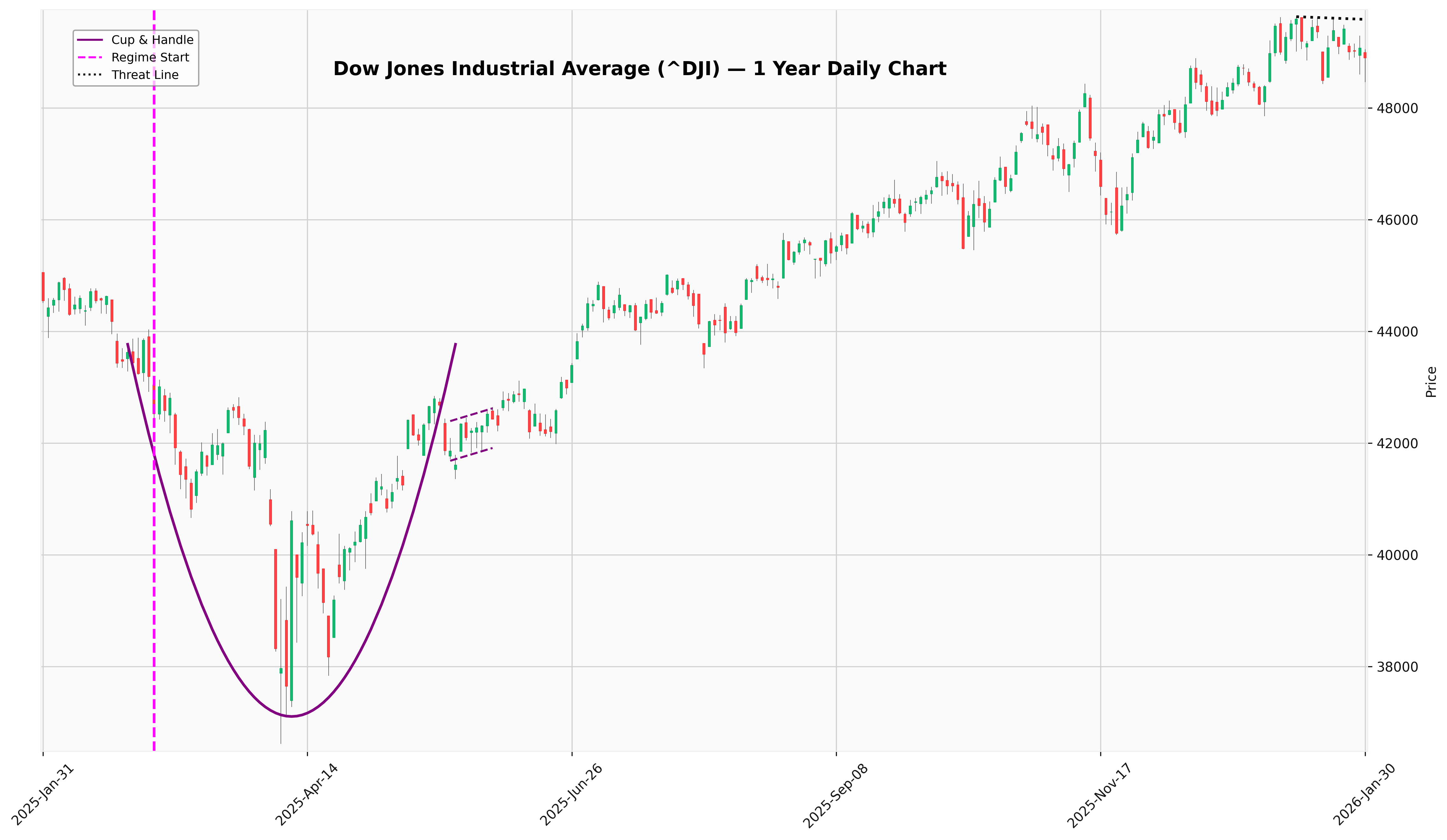

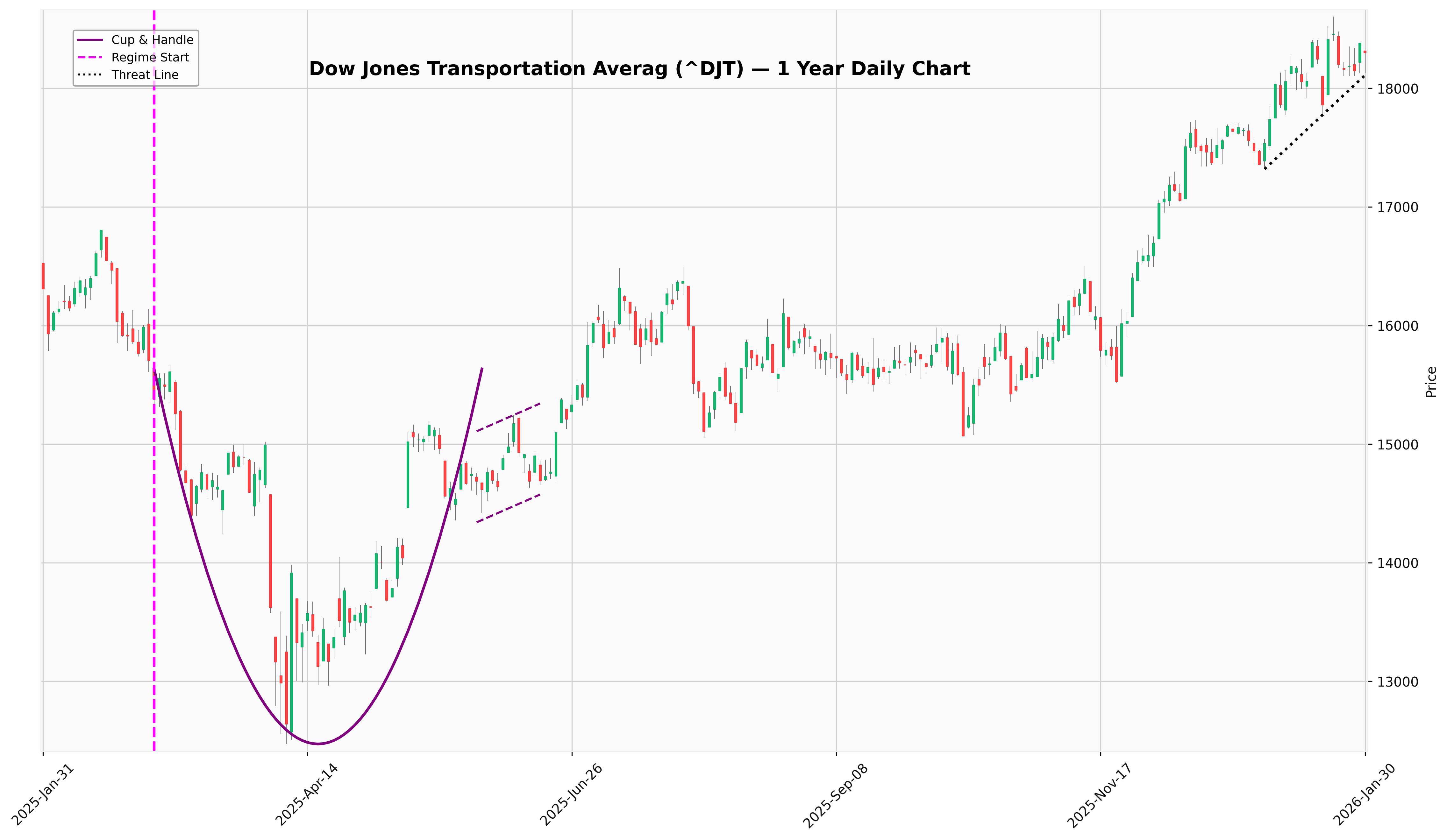

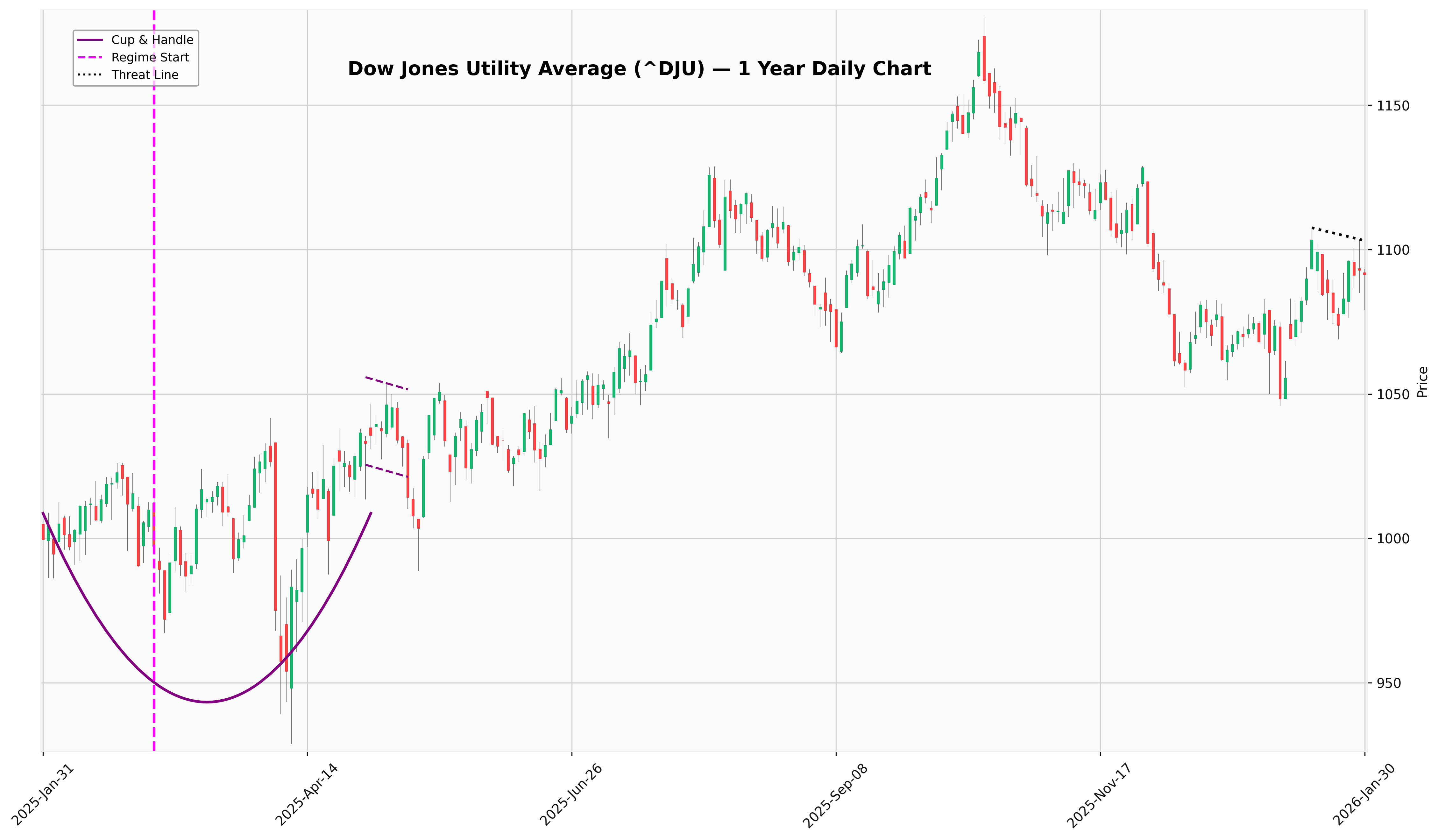

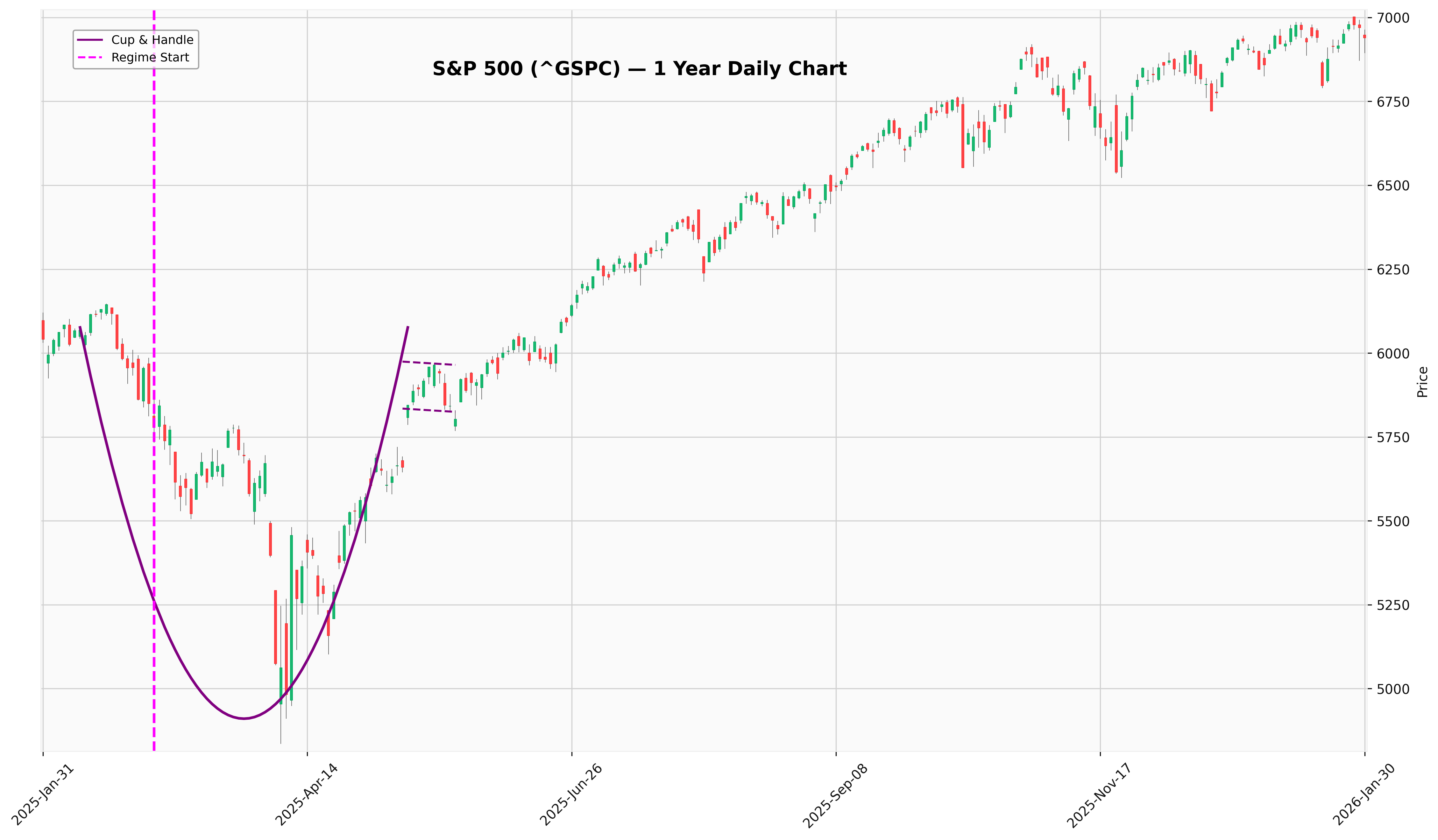

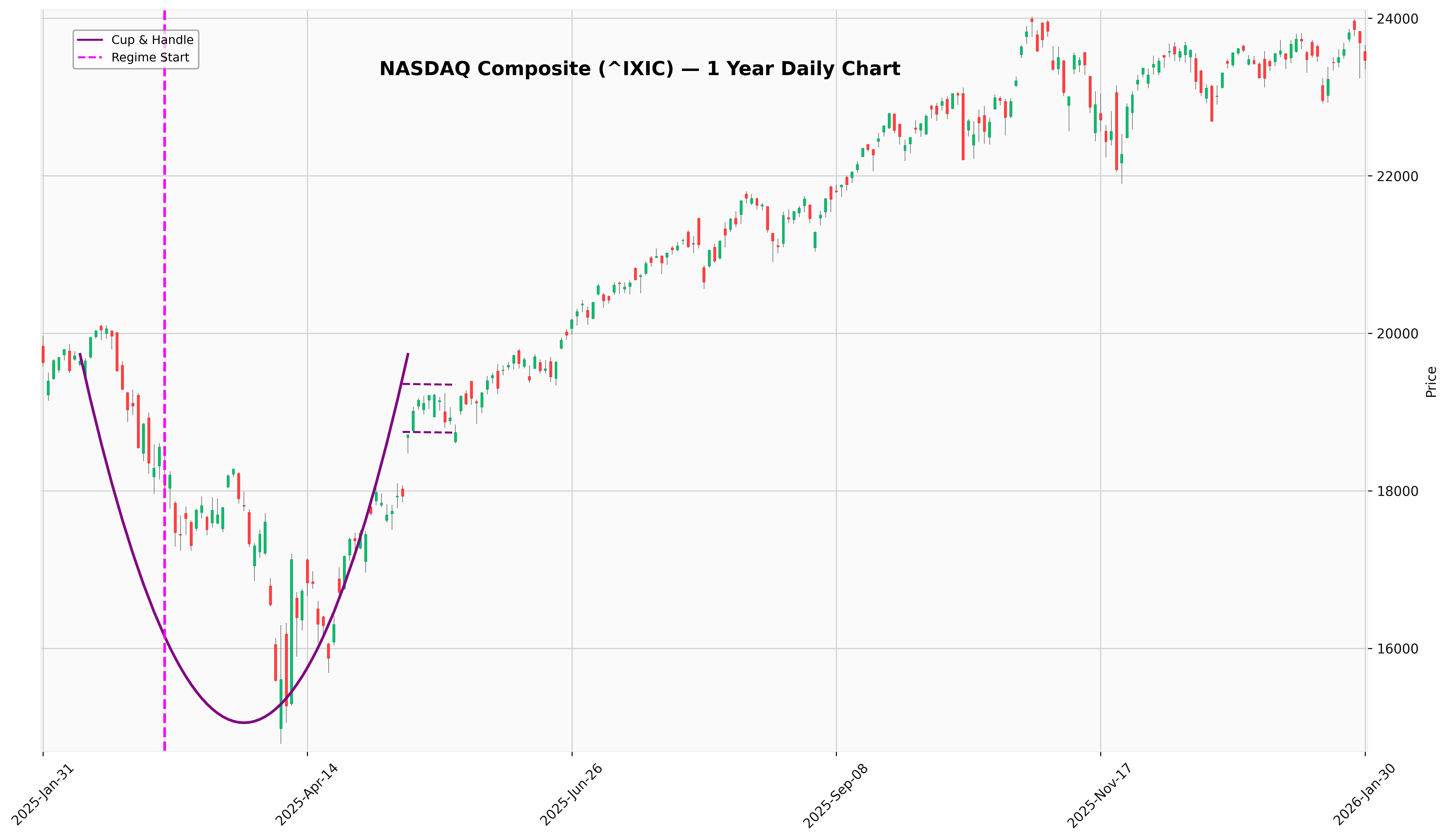

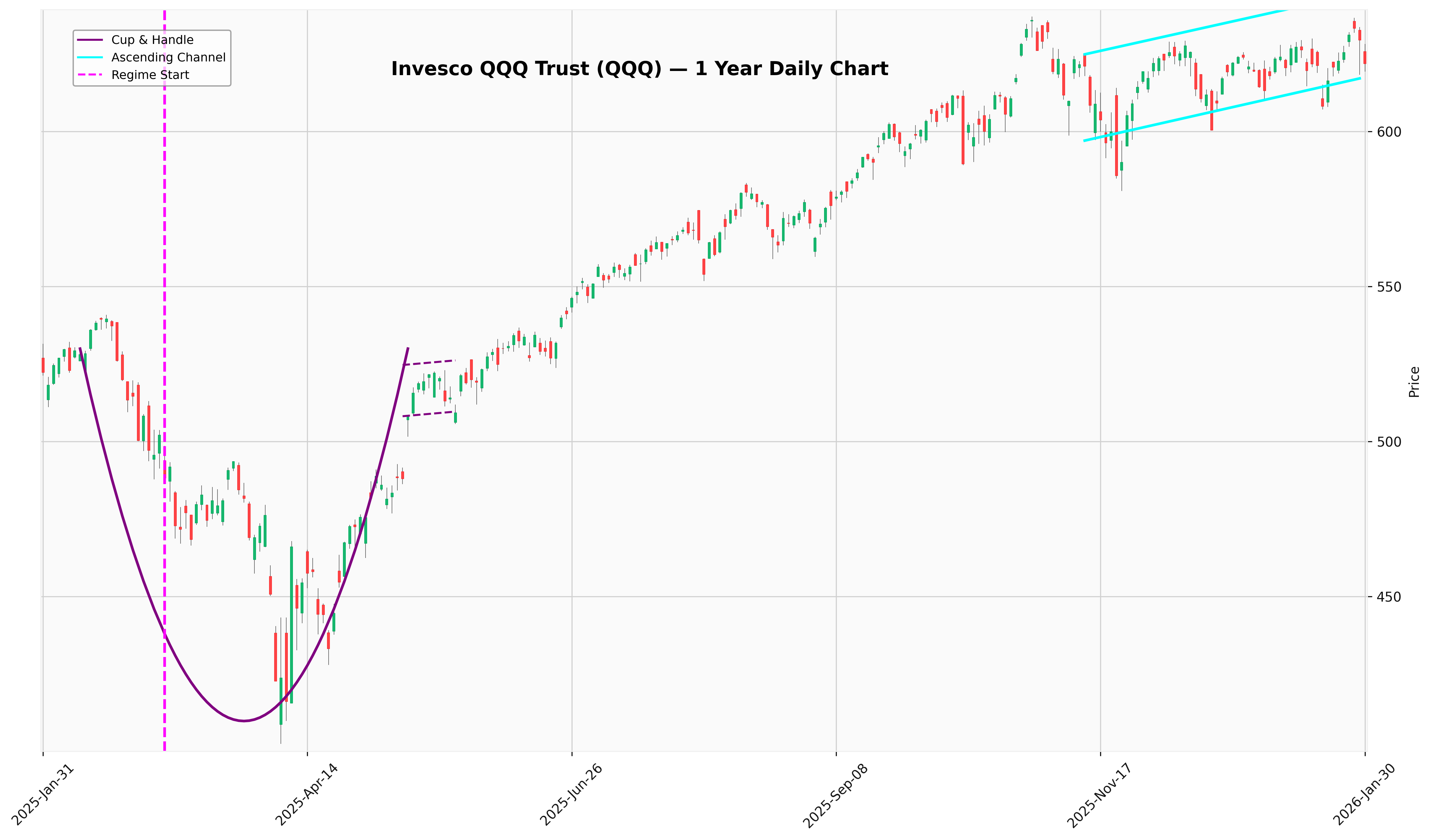

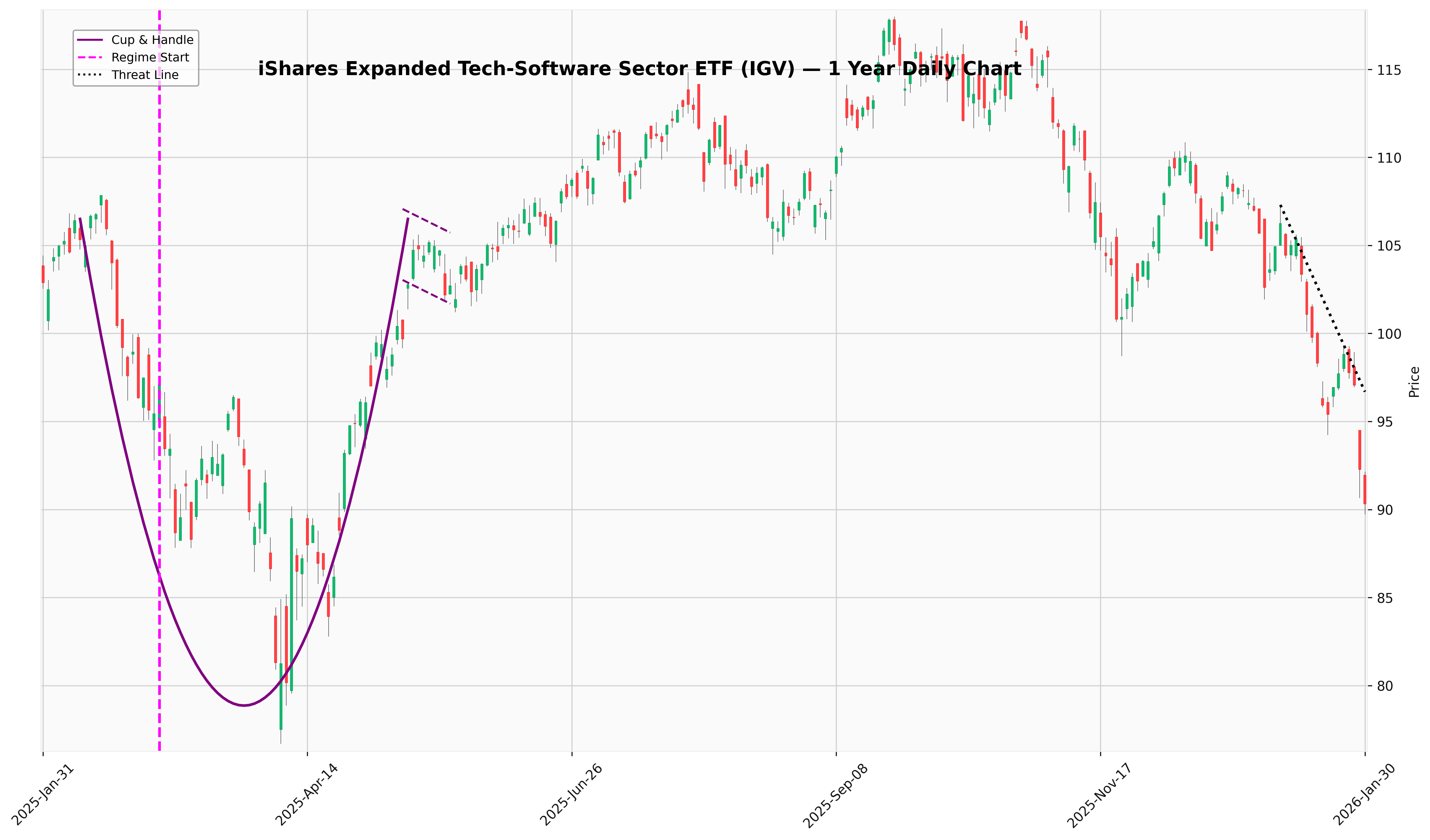

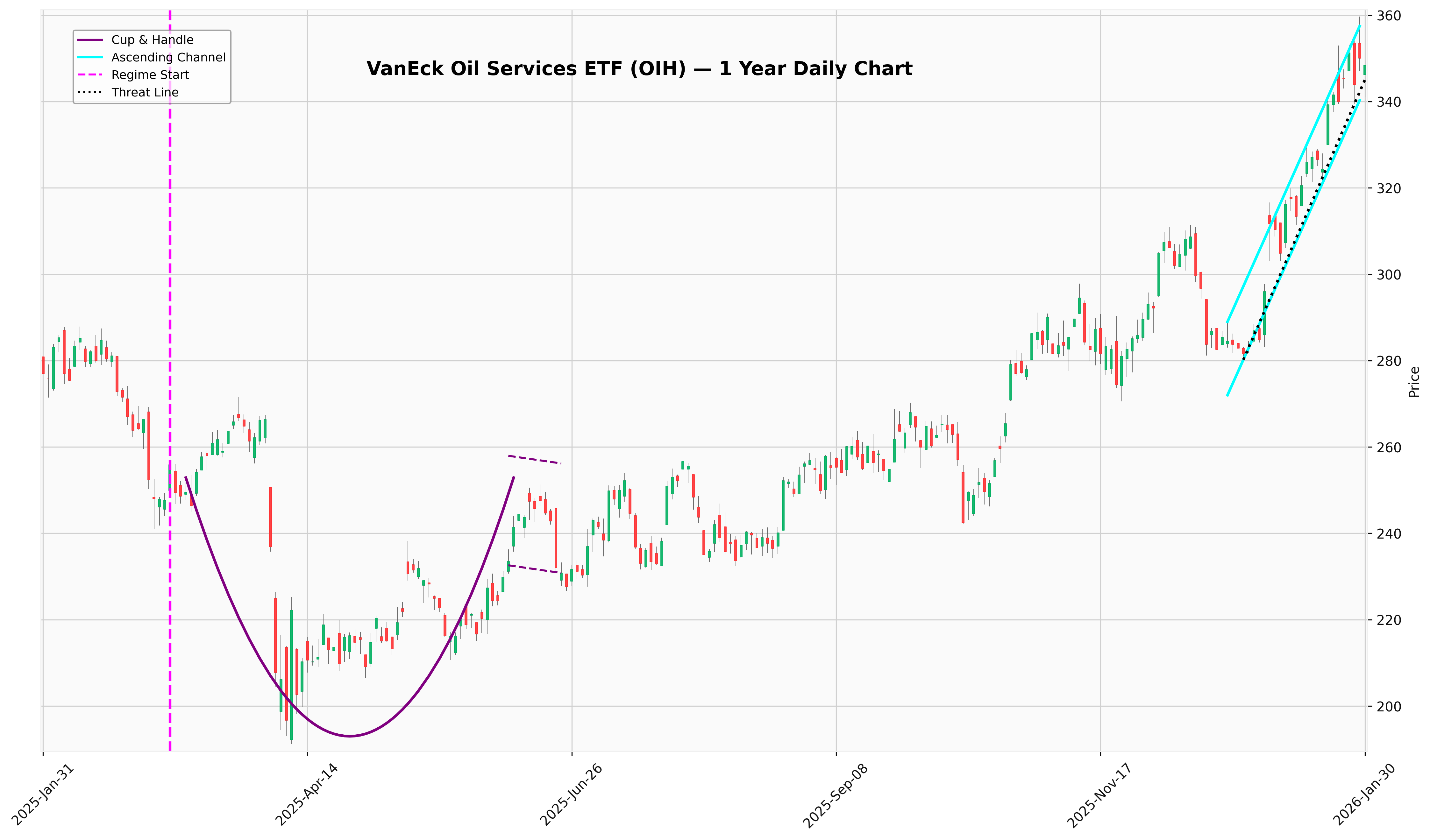

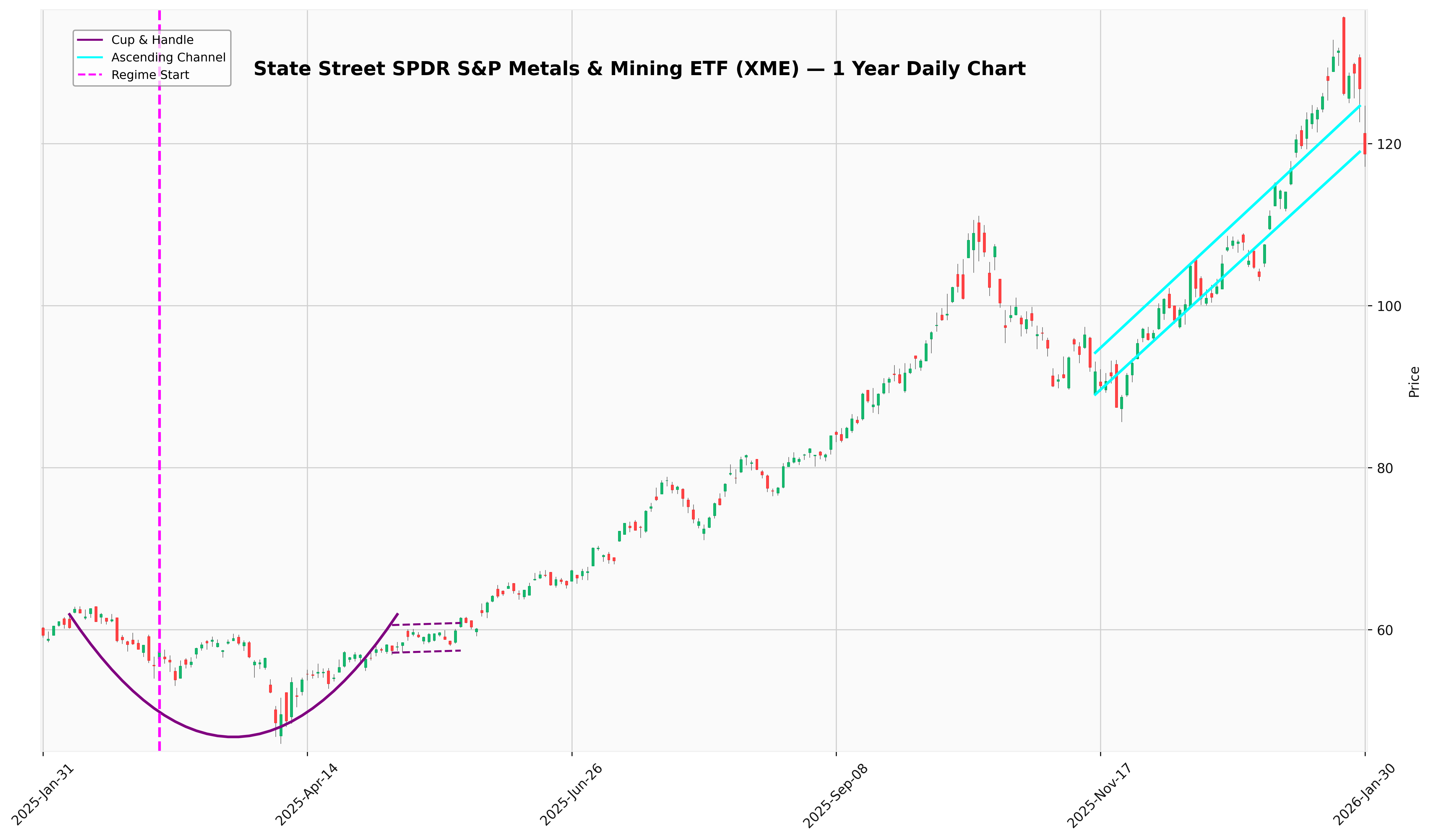

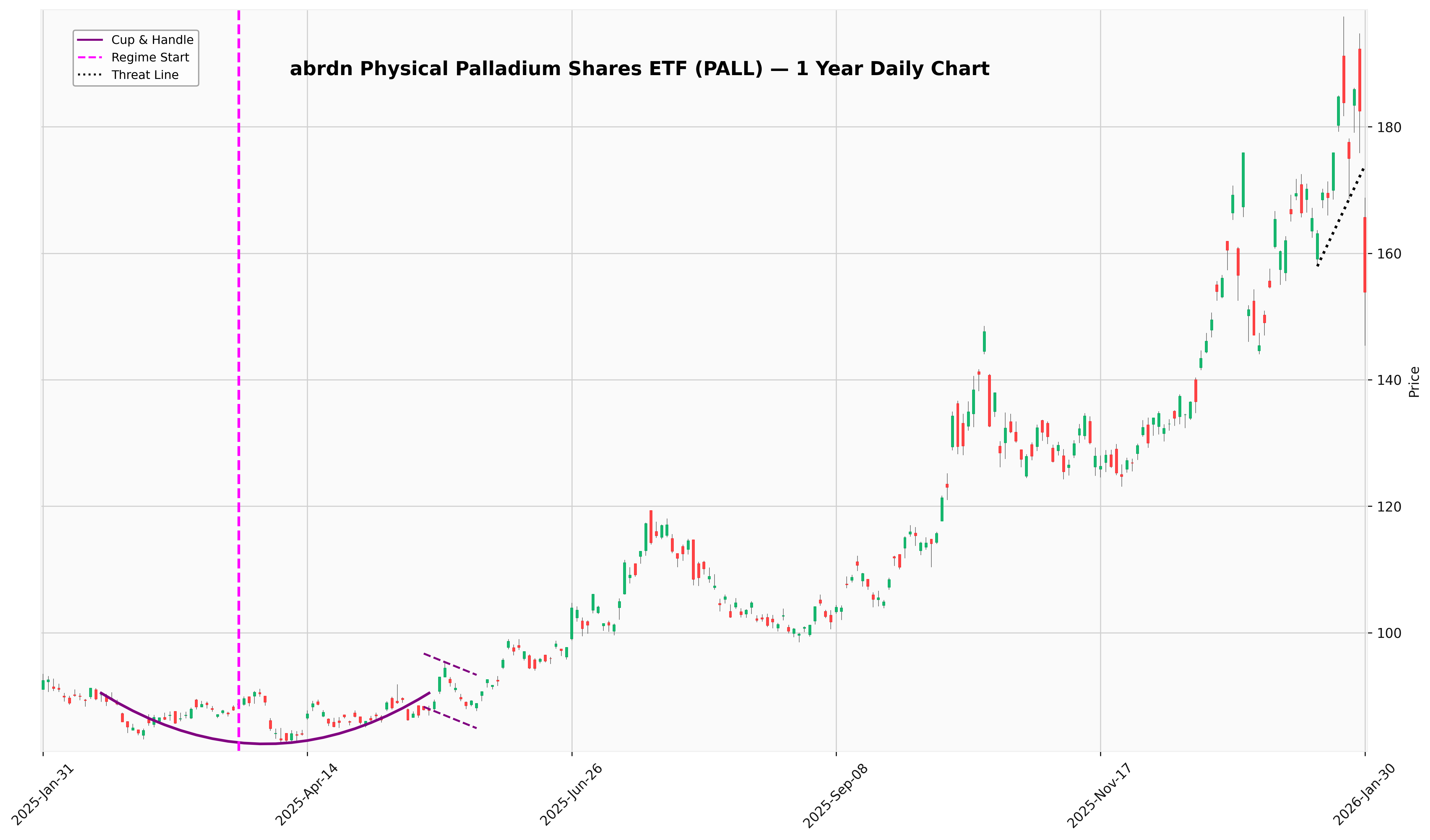

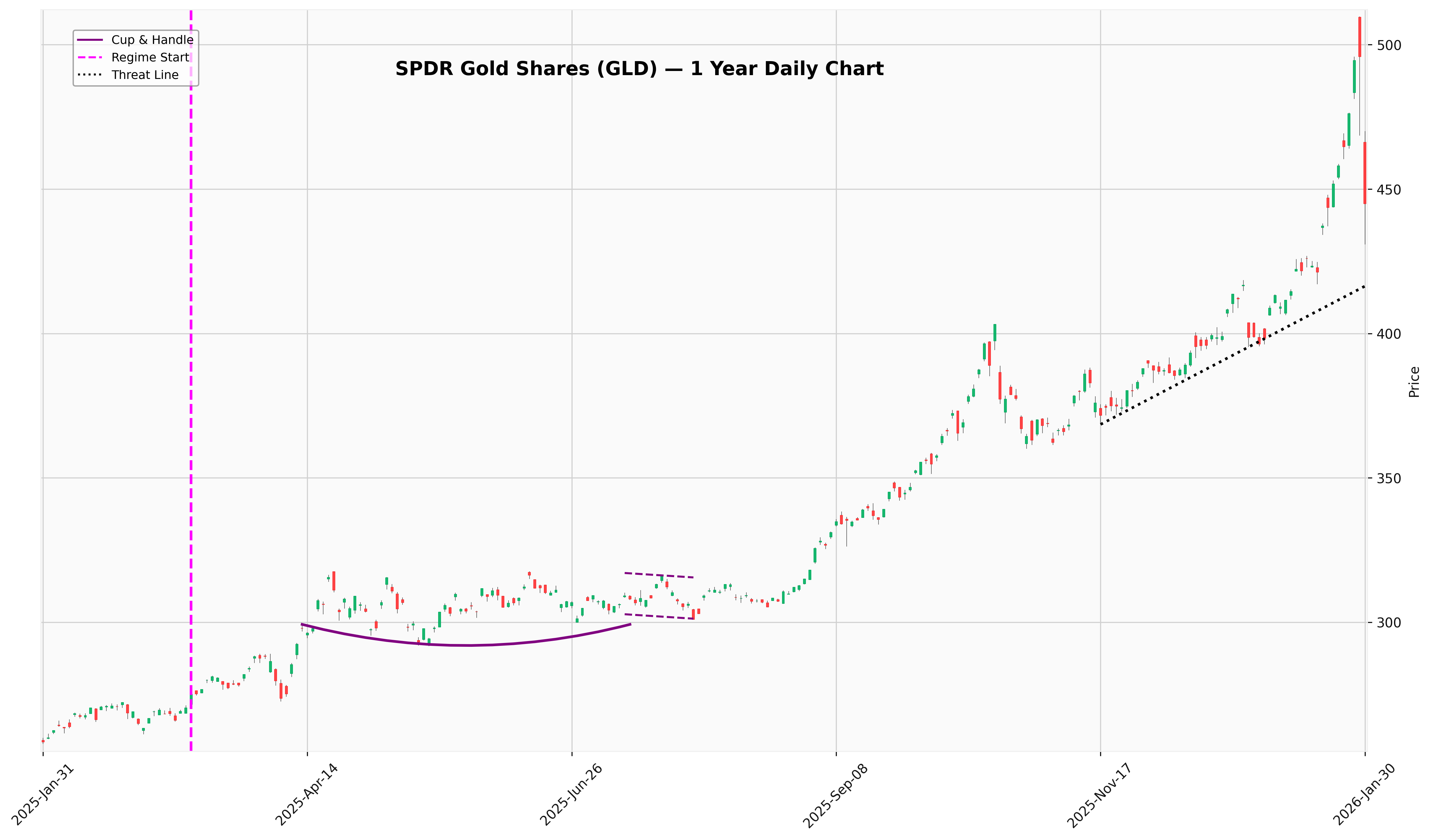

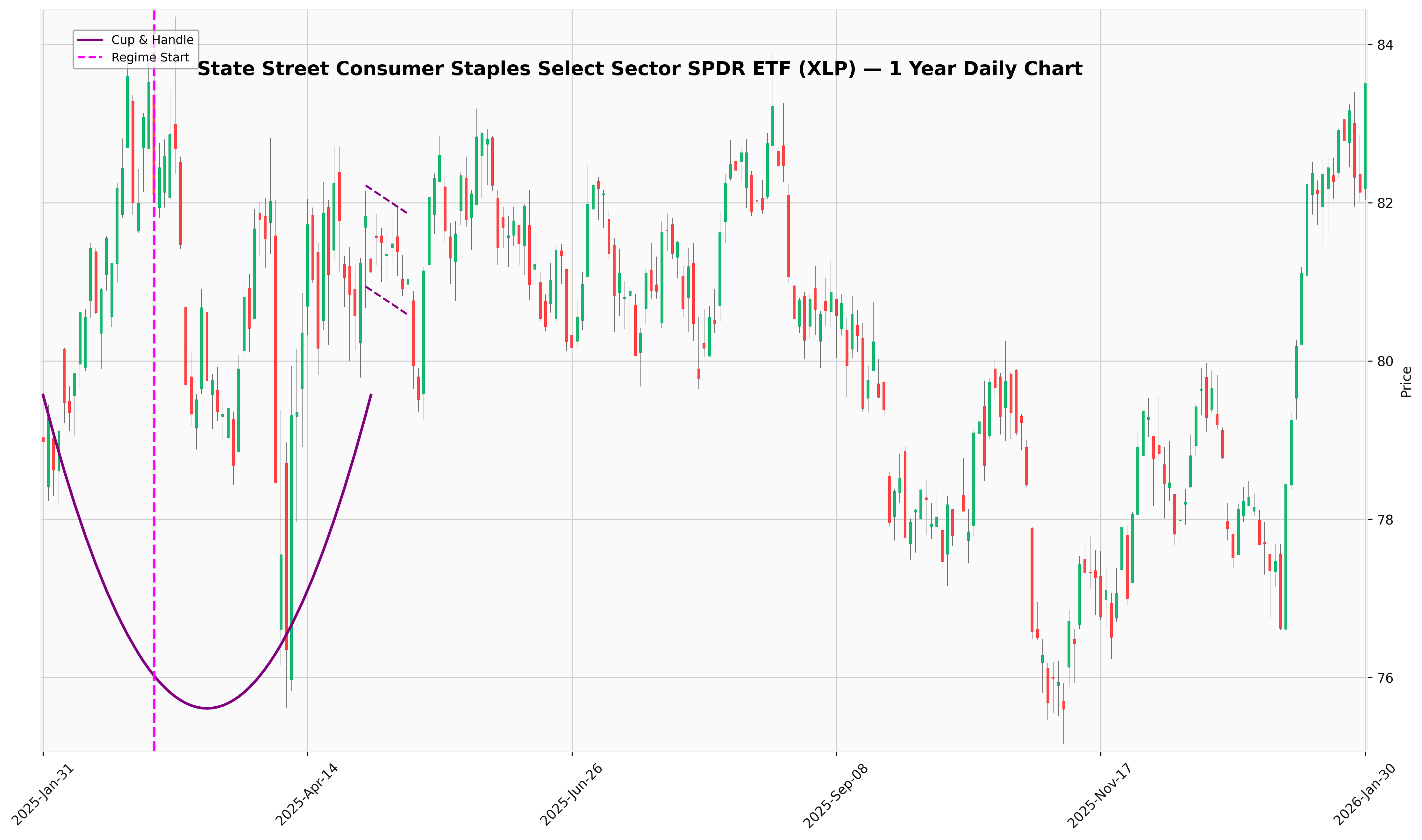

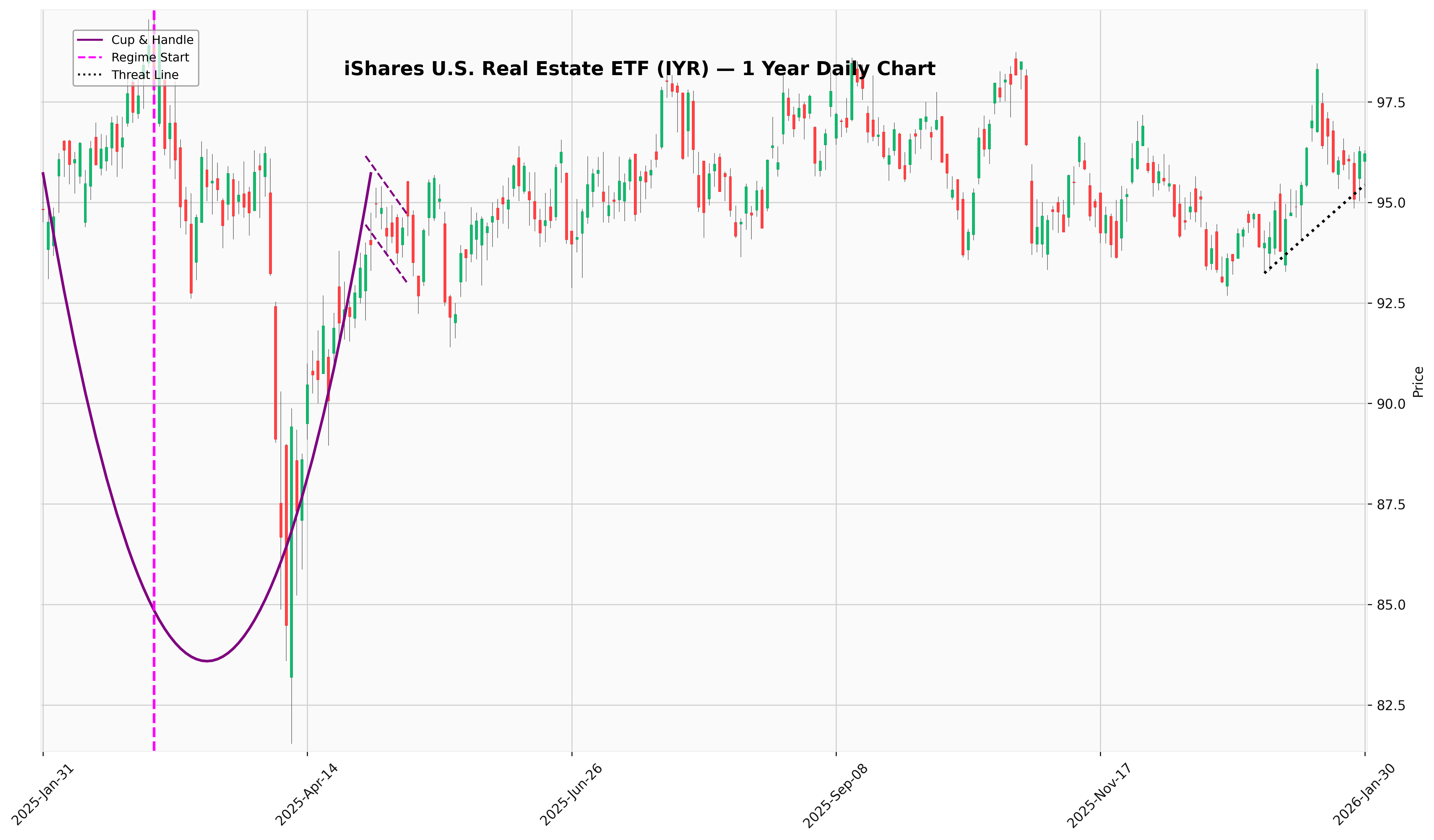

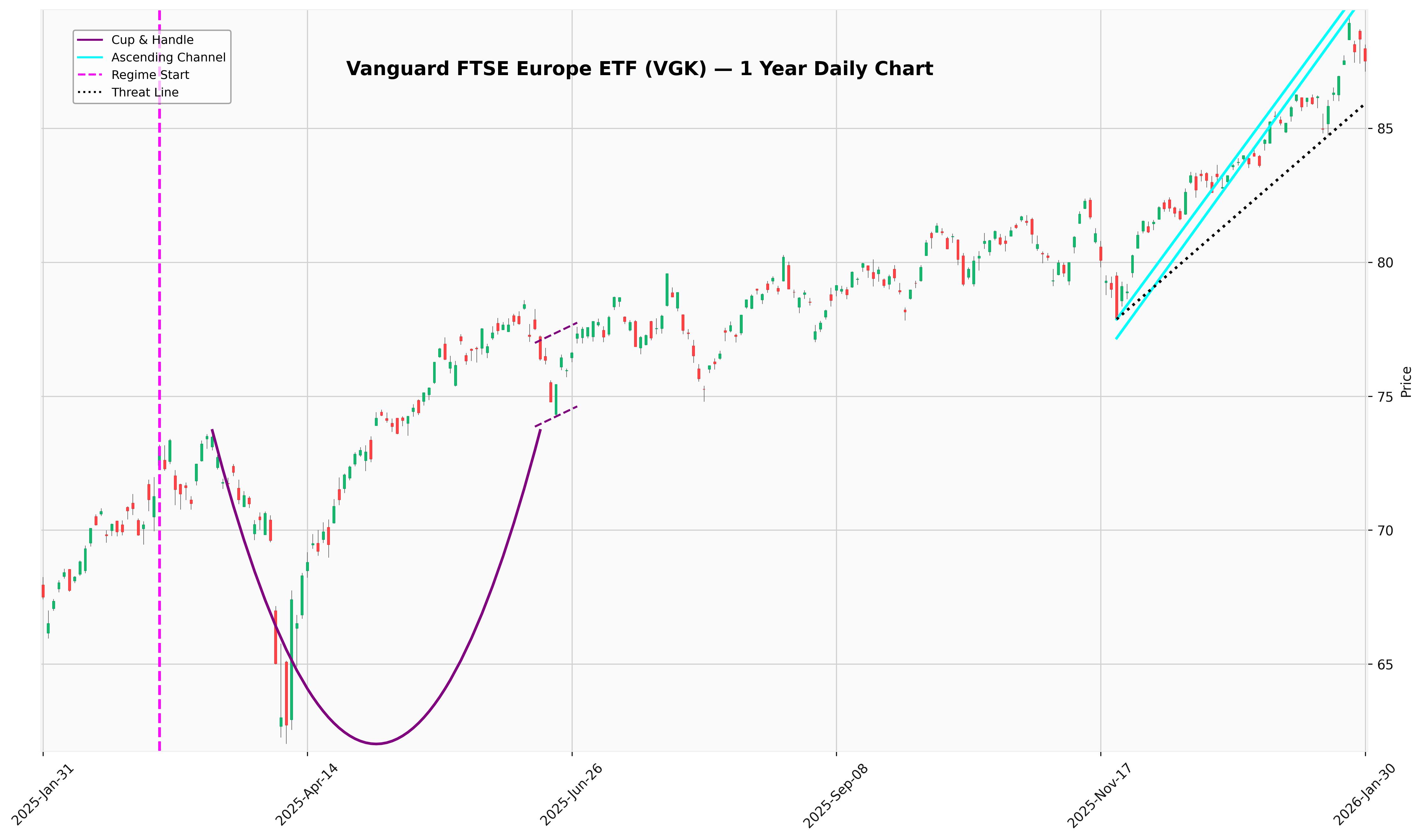

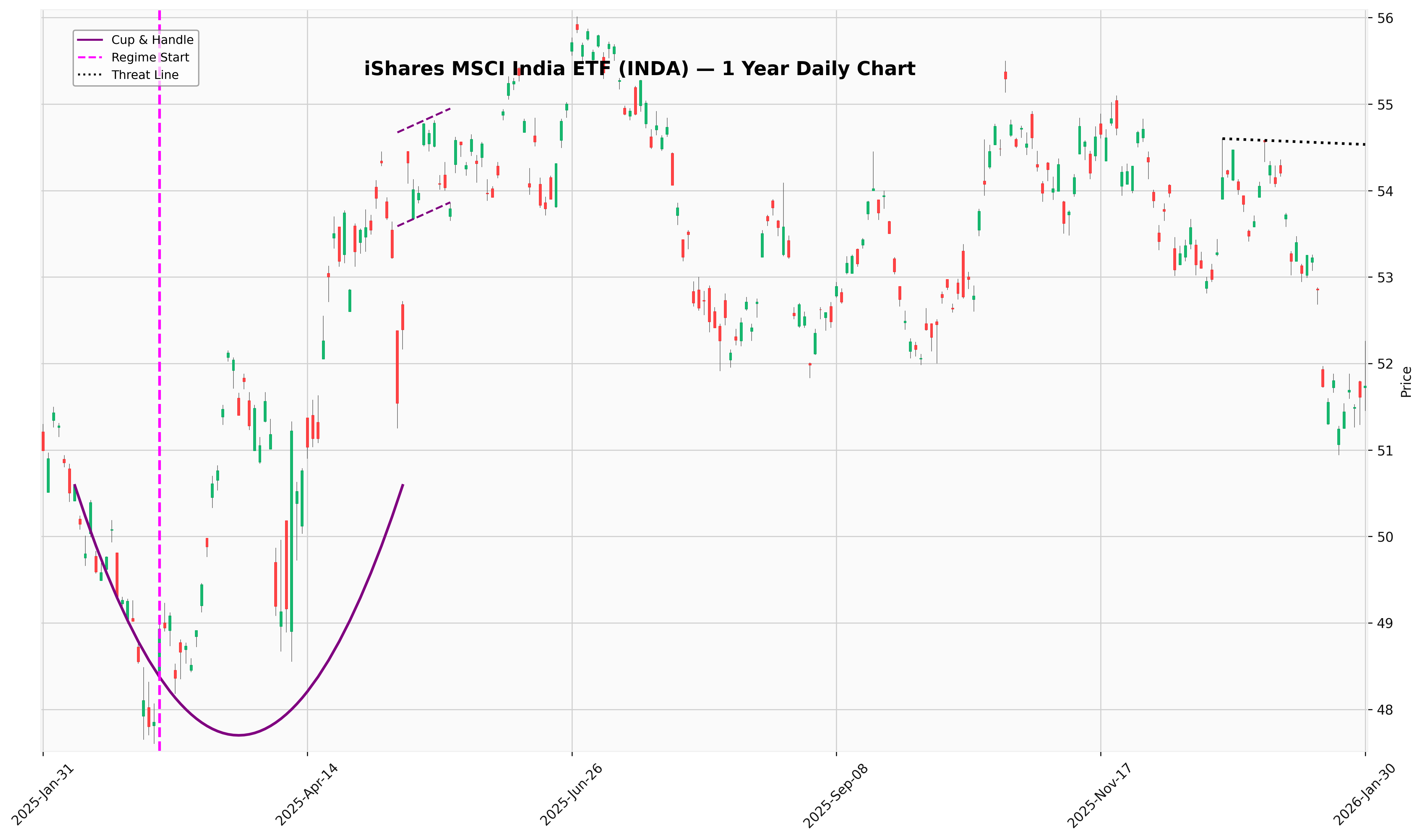

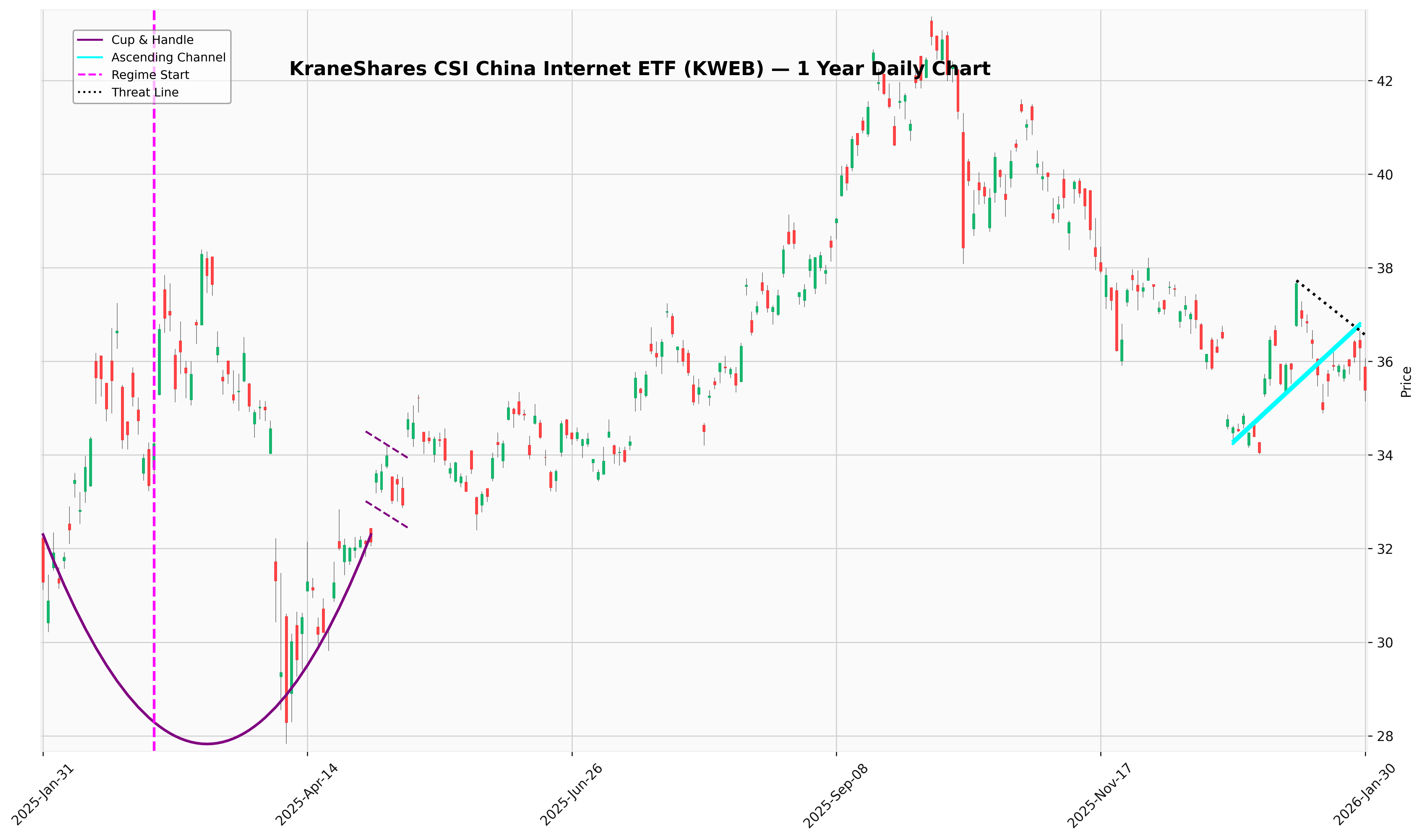

A bullish continuation pattern resembling a rounded base followed by shallow consolidation. It is often used to identify breakout opportunities within longer-term uptrends.

Two parallel trendlines that contain price movement within a controlled trend. Channels help visualize trend strength and potential support and resistance zones.

A line connecting key highs or lows to indicate directional pressure. Breaks in trendlines may signal shifts in momentum or regime.

Represents areas of price memory where trading activity previously clustered. These zones often act as support or resistance when revisited.

A period of sideways consolidation following directional movement. Shelves often precede either continuation or rejection depending on context.

Marks a contextual reset in market behavior or structure. It is useful for segmenting analysis and avoiding assumptions based on prior conditions.

A boundary representing elevated risk to the current pattern or bias. A breach of the threat line may invalidate the prevailing interpretation.